Population

How red or blue is your state?

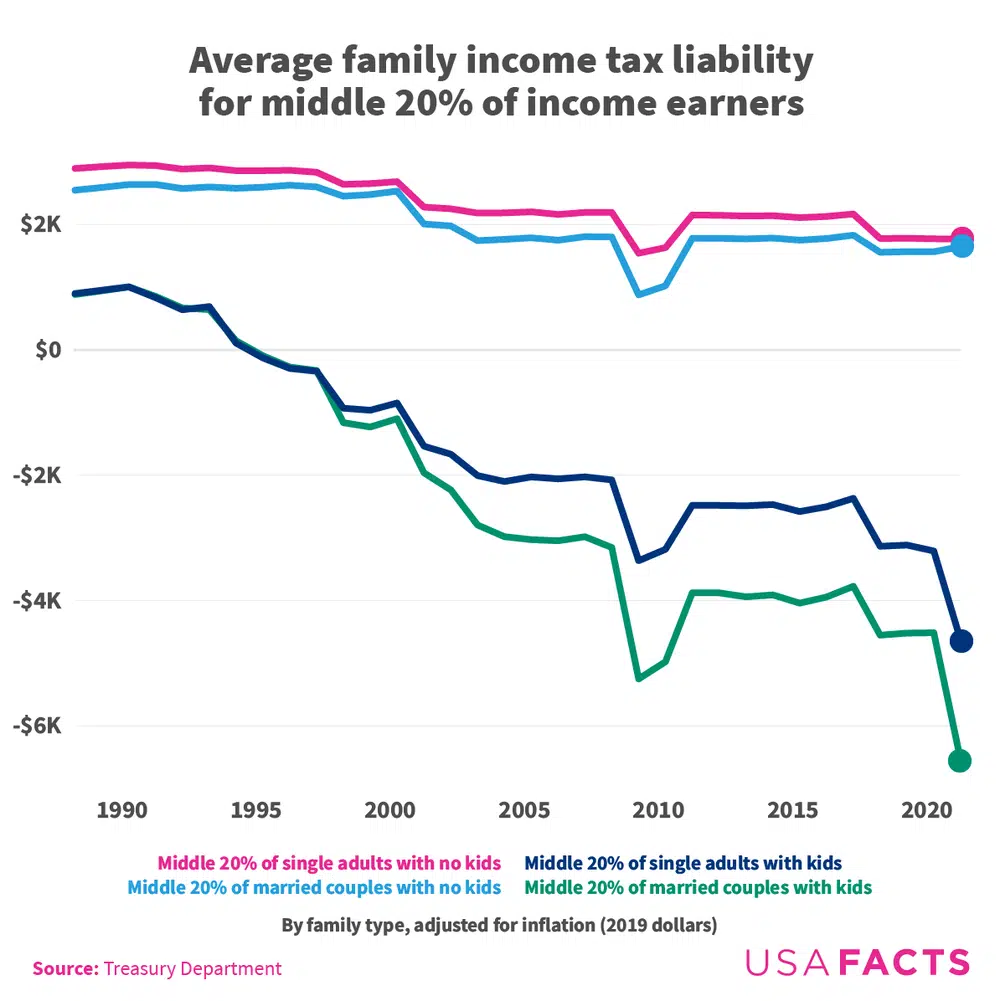

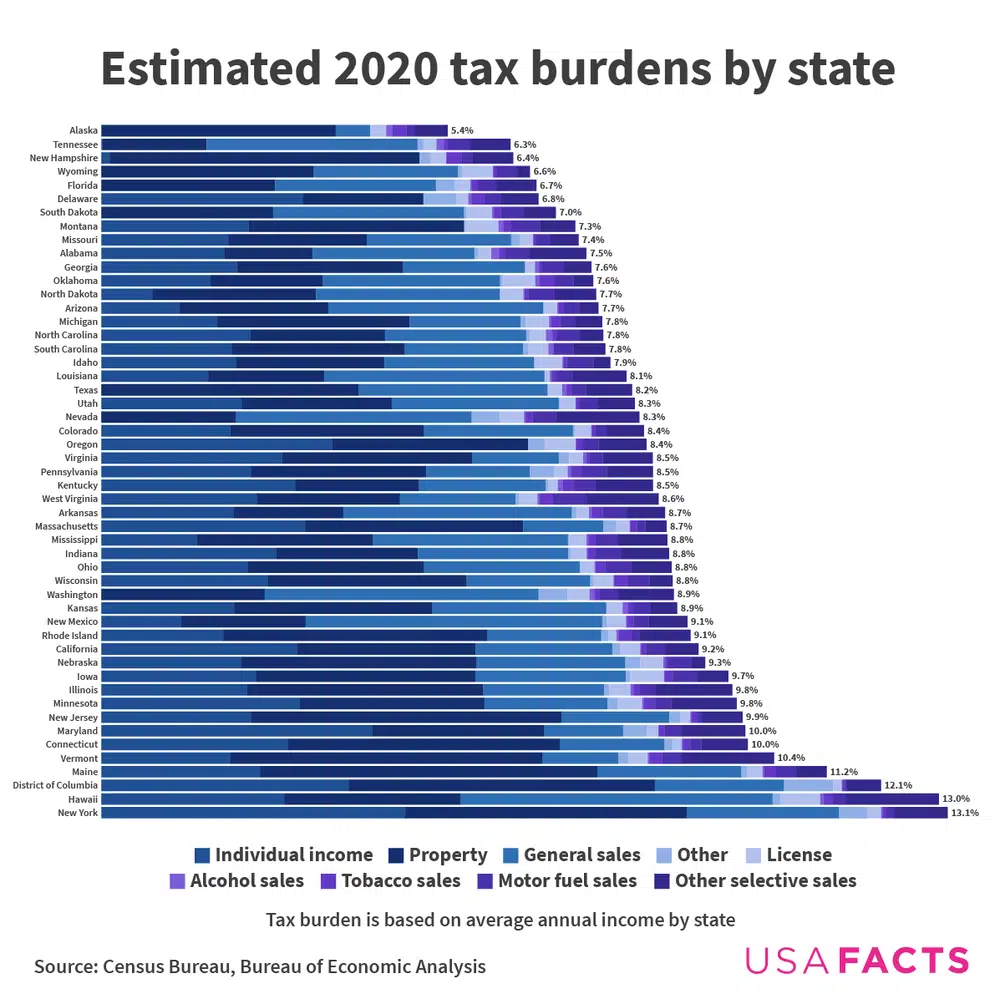

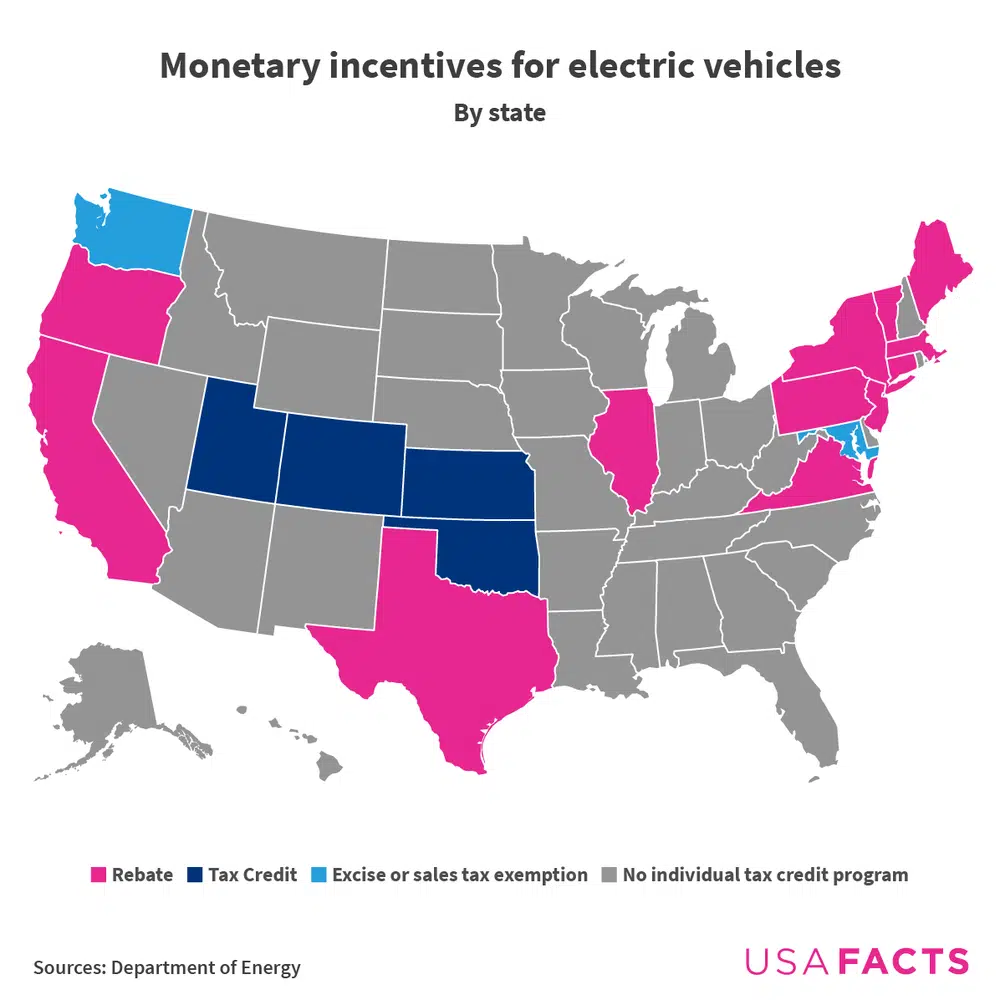

Tax Day is a week away. USAFacts has a bevy of data on the tax systems from different angles, including explanations of tax burdens and various credits for filers. Here are some of the most popular tax articles and data we have available right now.

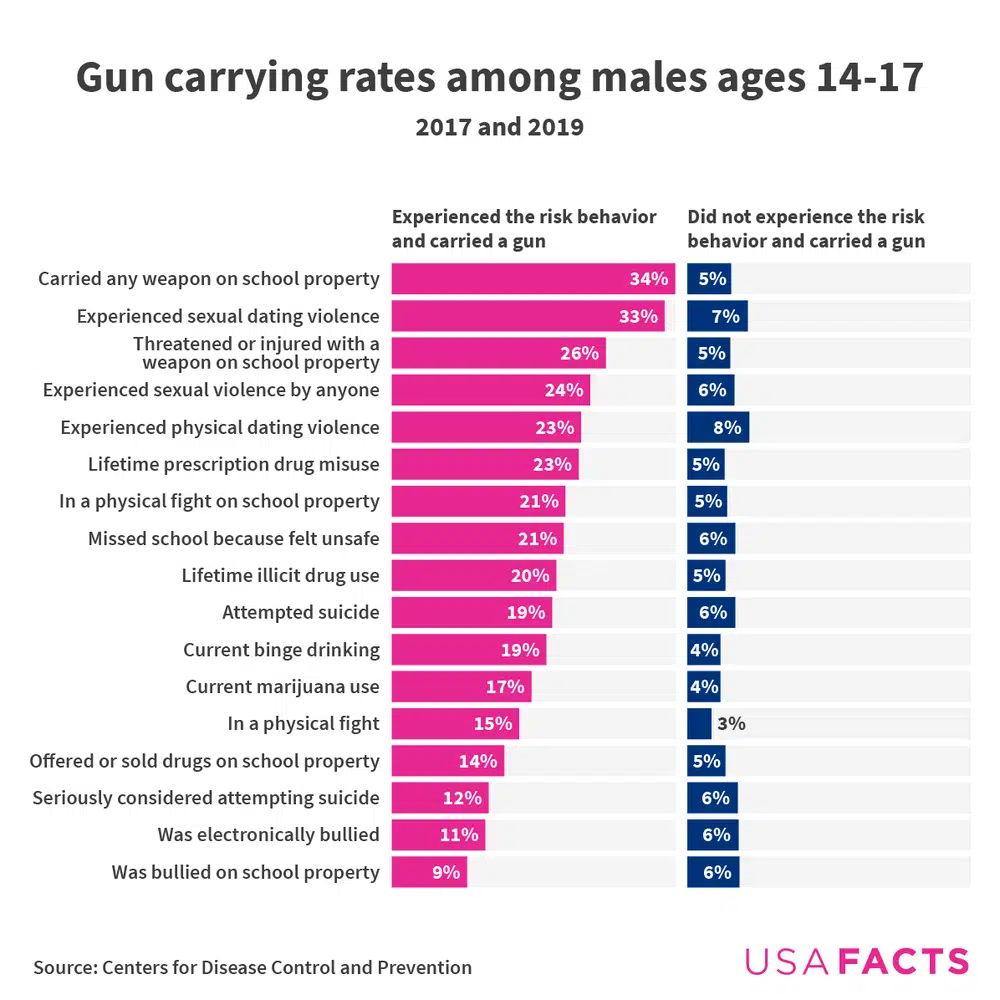

Preventing youth violence requires understanding the risk factors and reasons associated with gun carrying. The Centers for Disease Control and Prevention has data that sheds light on the reasons why some teenagers have carried guns in the past.

See more risk factors and data breakdowns in this article.

Finland became the 31st North Atlantic Treaty Organization (NATO) member on April 4. How does NATO work, what does it cost to join, and where has the alliance deployed in the past? Read this article for the answers.

Don't forget to test your knowledge in the weekly fact quiz!

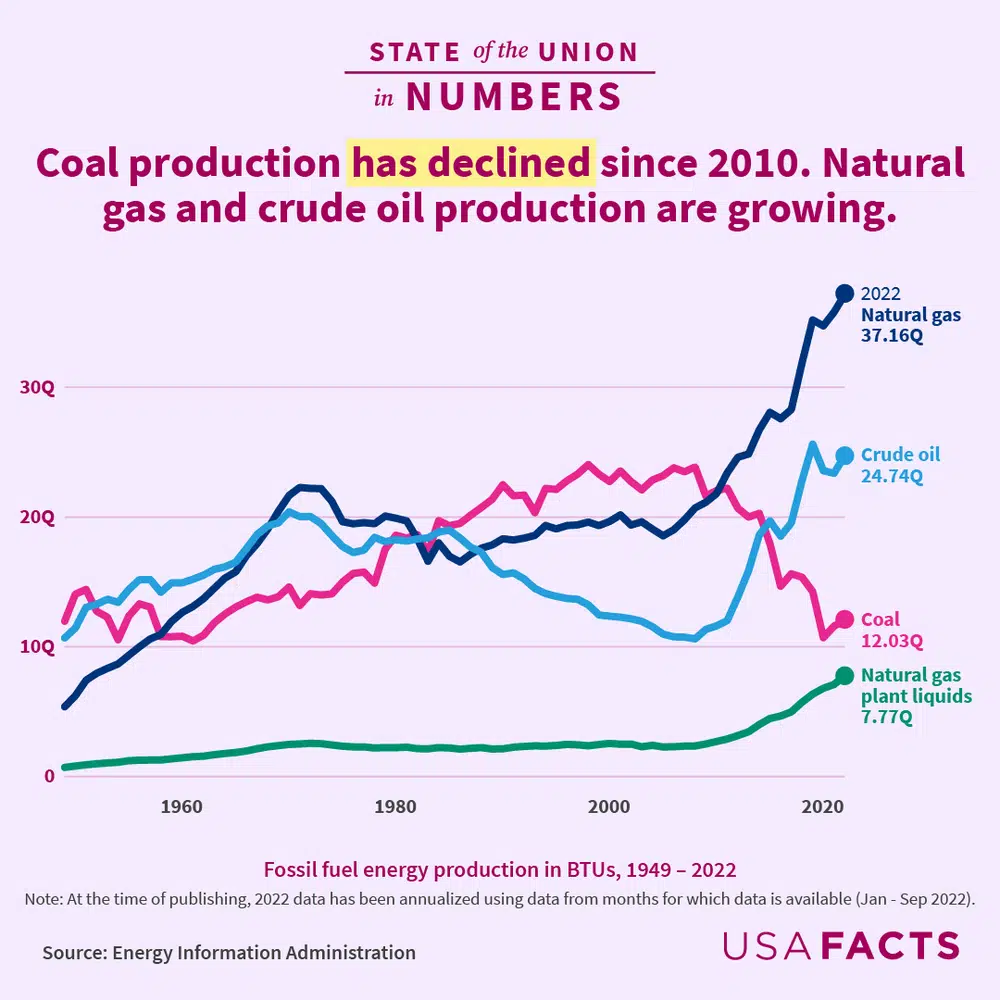

US coal production has declined since 2010. The nation's fossil fuel production increased from 2021 to 2022. Learn more about American energy production and consumption in the State of the Union in Numbers.

Want easy-to-read data like this in your inbox every Monday? Sign up for the USAFacts newsletter.

Newsletter

Keep up with the latest data and most popular content.