What do the CARES Act and its $1,200 relief checks mean for individuals?

The $2 trillion CARES Act has a lot in it. What does it mean for individuals, and what will relief checks cover for the average American household?

Of the $2 trillion distributed in the Coronavirus Aid, Relief, and Economic Security (CARES Act), approximately $300 billion is dedicated to providing direct cash relief to Americans.

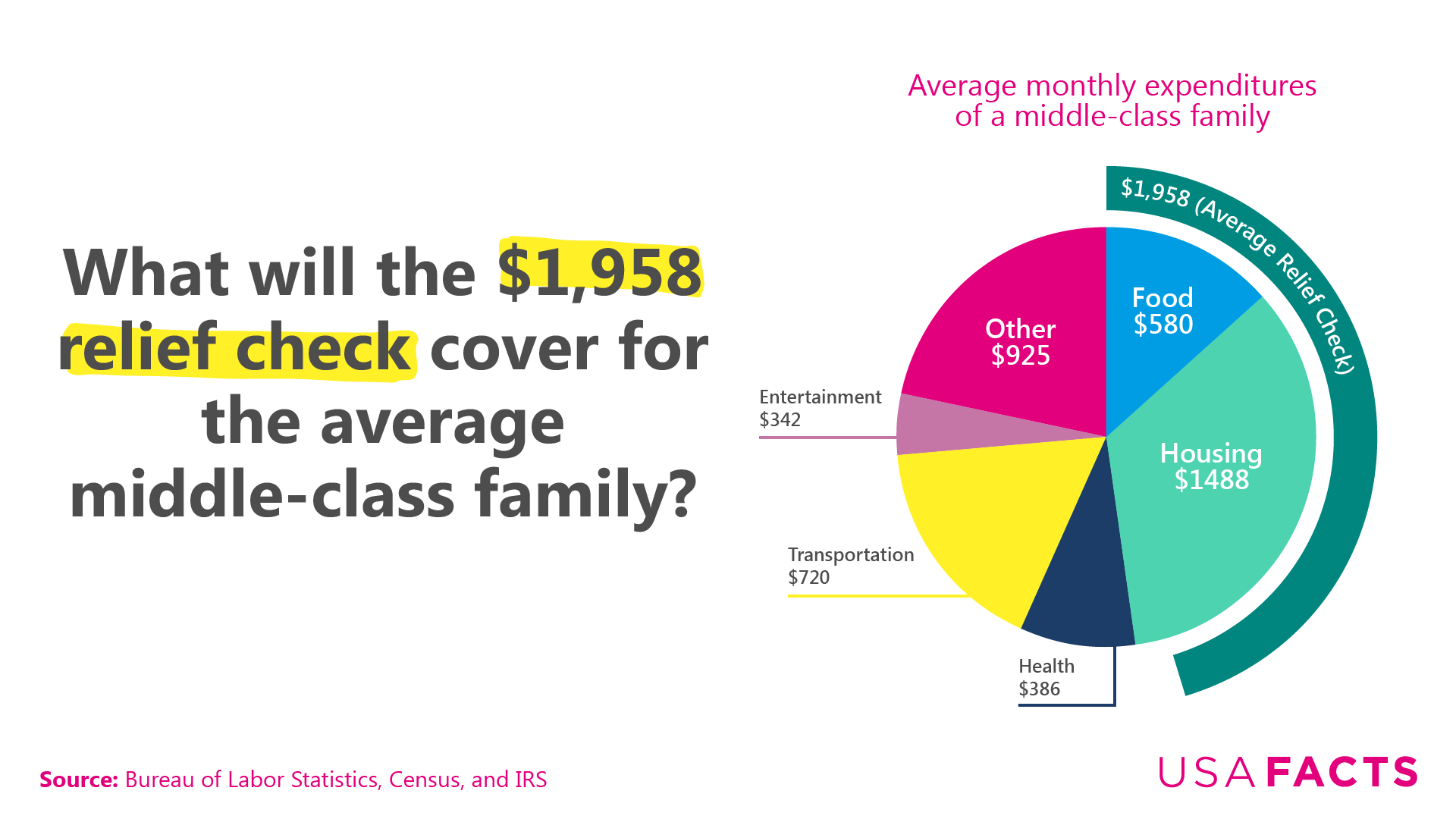

As USAFacts described in detail in a recent piece, a significant part of the legislation is a program to provide $1,200 tax rebates to qualifying individuals, with an additional $500 payments per qualifying child. The rebate begins to diminish at income levels above $75,000 (or $150,000 for joint filers). Families in the middle class, or the middle 20% of income earners ($33,000 to $66,000 in income), can expect to gain about $1,958 from the relief checks.

What exactly will the relief check cover for Americans? For reference, the monthly median household income in 2018 was $5,161, and the median gross rent as of 2018 is $1,023, according to the Census Bureau. According to the Bureau of Labor Statistics, the average middle class (middle 20% of income earners) household spent roughly $1,000 per week in 2018, with about $133 per week going towards food and $343 per week going towards housing. Households in the lowest 20% of income earners spent roughly $500 per week.

For full analysis of the CARES Act and related recent legislation, see our recent article.

Learn more from USAFacts and get the data directly in your inbox by signing up for our newsletter.