Crime

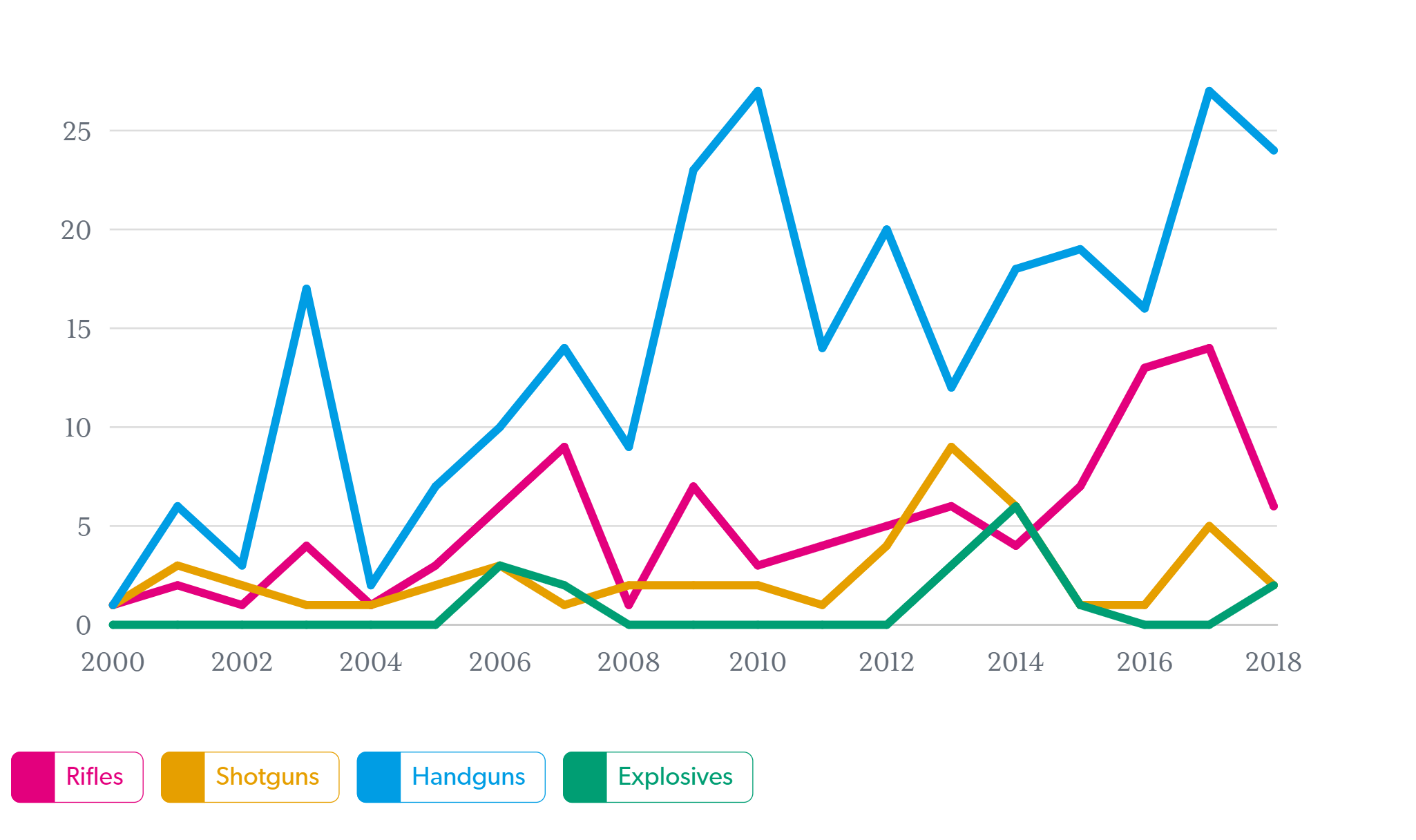

The federal data available on active shooter incidents, mass killings and domestic terrorism

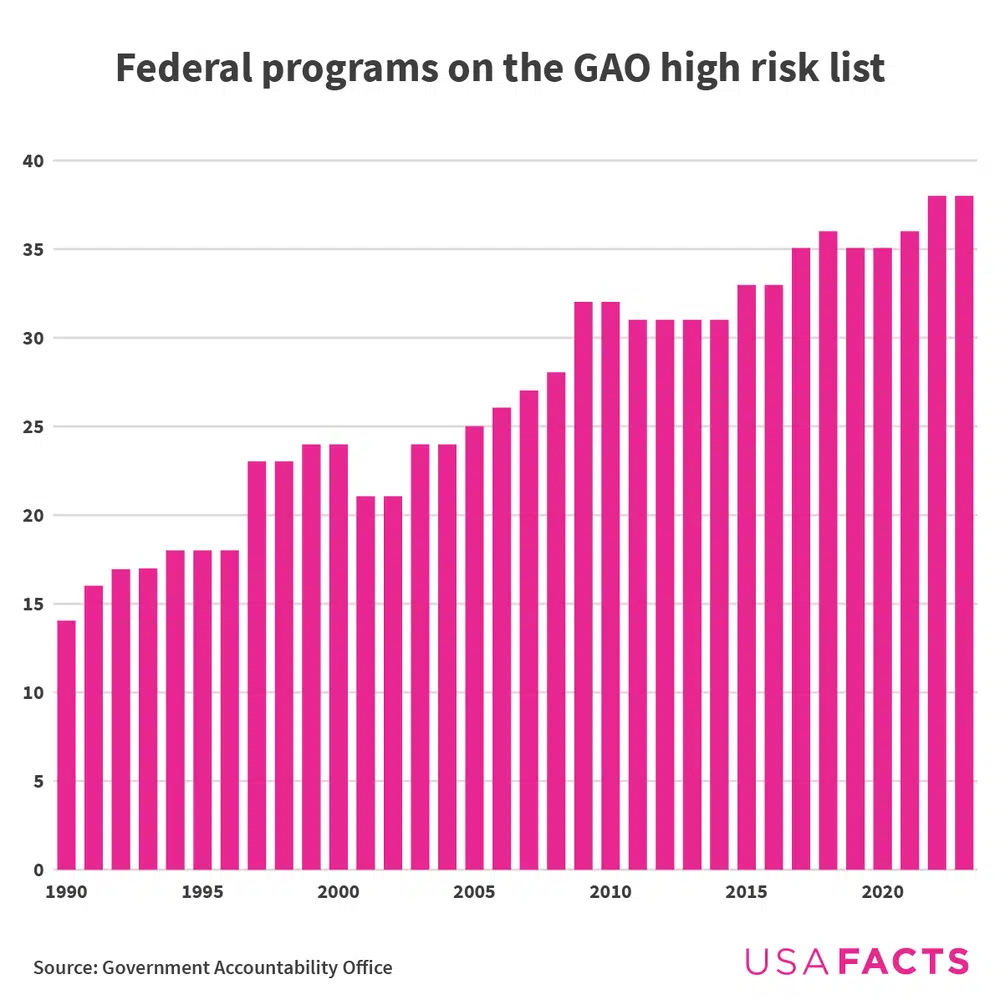

The Government Accountability Office (GAO) is an independent agency that provides unbiased information to help run the government more efficiently and save taxpayers money. The GAO has produced a high risk list since 1990 to identify federal programs vulnerable to waste, fraud, abuse, and mismanagement. As of March, 38 programs were on the list.

To see more, including the current high risk list, click here.

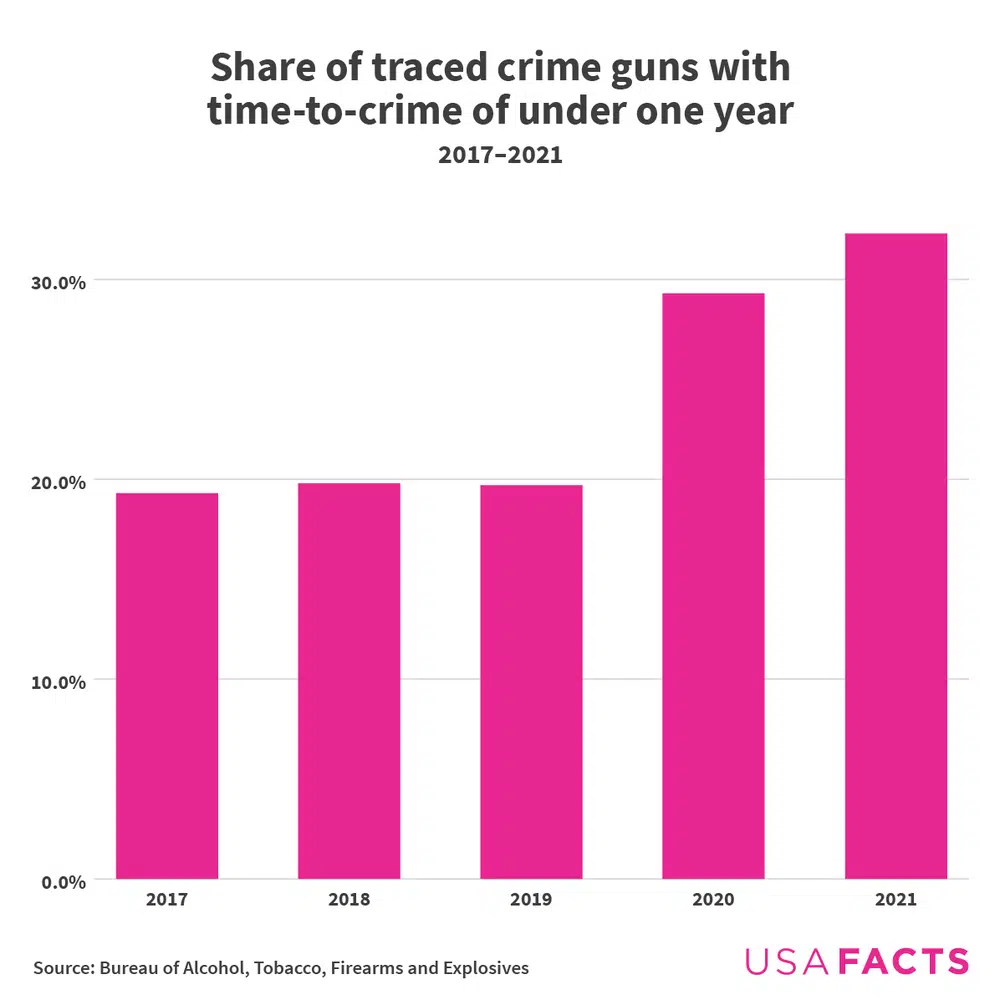

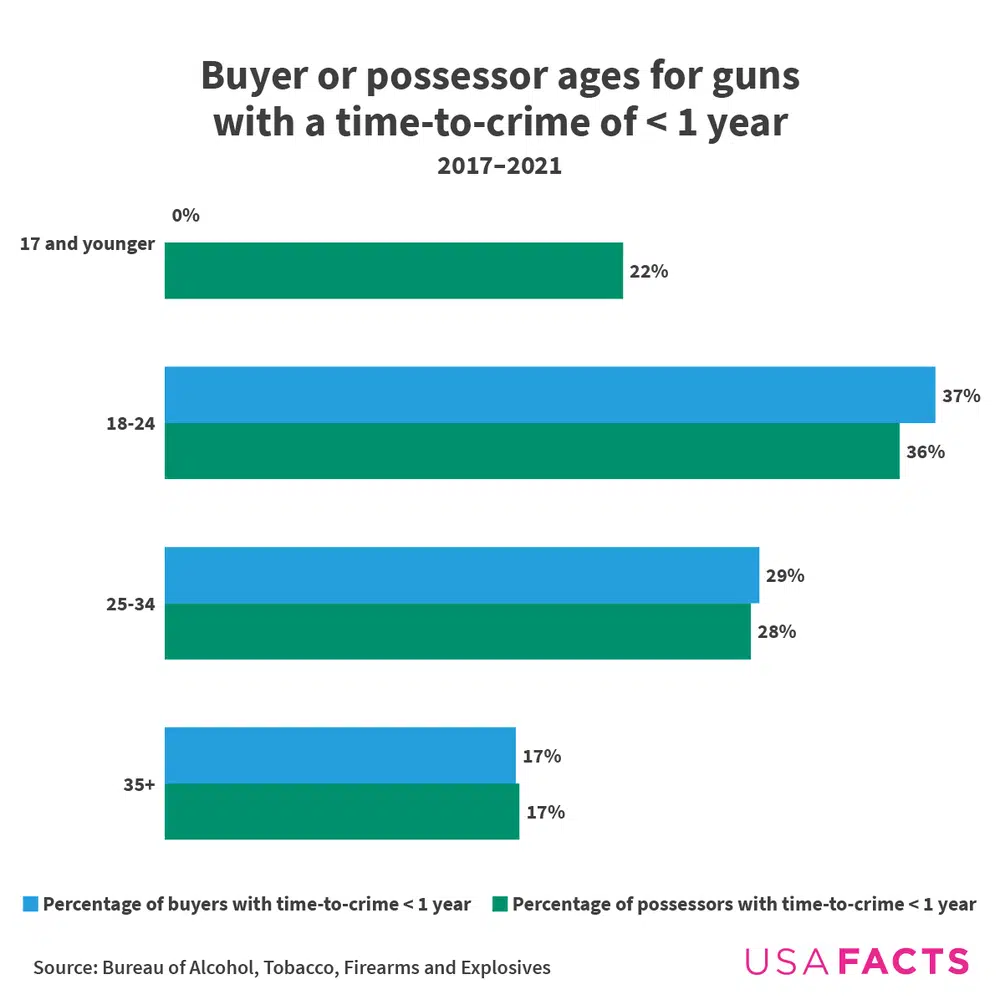

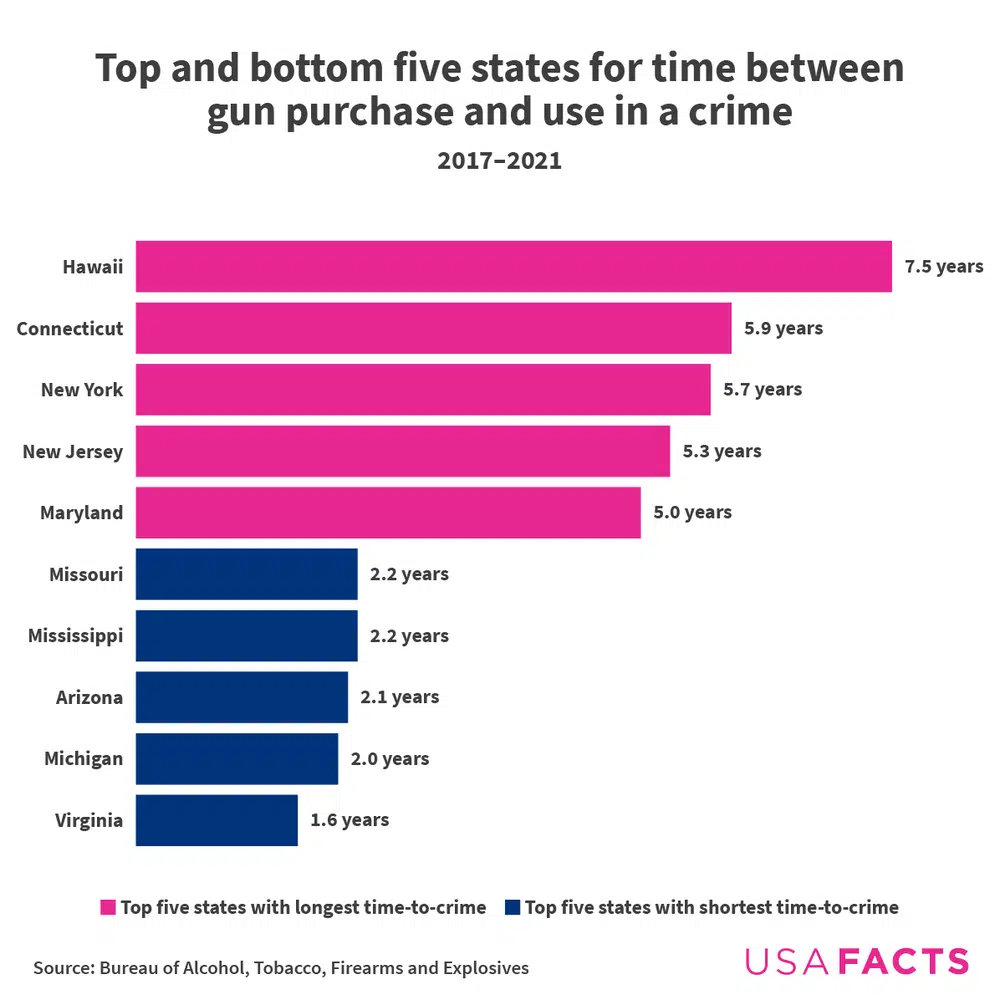

Read more about the length of time between a gun’s purchase and its use in a crime plus the buyers and possessors of guns.

On Monday, JPMorgan Chase announced it would buy most of First Republic Bank after the latter bank failed. Here’s a refresher on the history of US bank failures.

The NFL draft was last week. And while the league does not stipulate that draftees must have attended college, virtually all of them have. USAFacts has this 2020 look at what football means for universities' bottom lines.

Take the newest weekly fact quiz here!

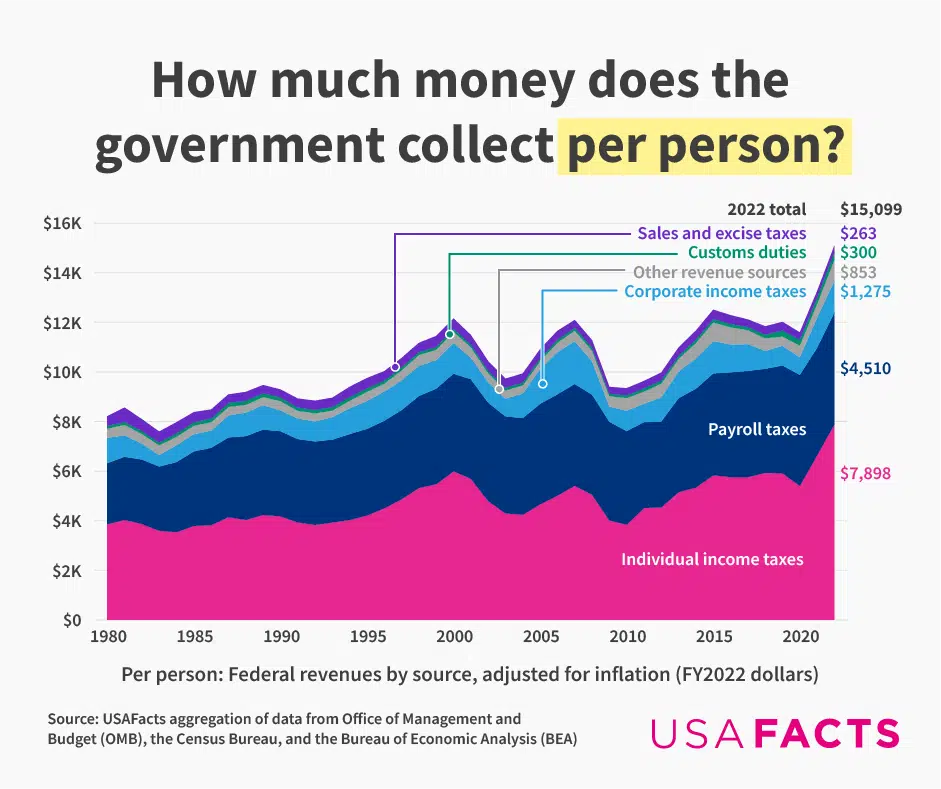

The federal government collected $5.03 trillion in revenues in 2022 (adjusted for inflation), up $630 billion from the previous year. Americans contributed an average of $15,098 per person to federal revenues — nearly double what they paid 40 years ago.

According to a Congressional Budget Office report, federal revenues grew in 2022 due to increased individual income tax collection. Despite recent changes to the tax code, roughly 40%–50% of federal revenues come from income taxes.