A data-driven guide to

Federal finances

Intro

The US federal government’s finances affect nearly every aspect of daily life, from the roads people drive on to the taxes they pay. Explore data on how the government collects and spends money, where funds are distributed, and the financial challenges it faces.

Federal revenue and spending

The federal government collects money—mostly through taxes—and spends it on various programs, with funds also flowing to state and local governments and to other countries as foreign aid.

- Federal spendingIn FY 2024, the federal government spent $6.8T.Source: Office of Management and Budget and US Department of the Treasury

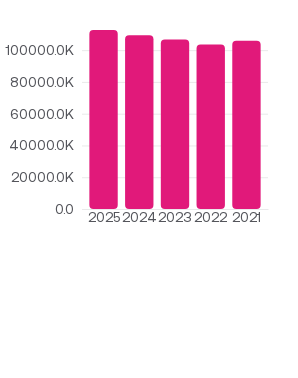

- Federal RevenueIn FY 2025, the federal government collected $5.26T in revenue.Source: Office of Management and Budget and US Department of the Treasury

- Federal money to statesIn FY 2024, the federal government provided $1.1T to state and local governments.Source: Office of Management and Budget and US Department of the Treasury

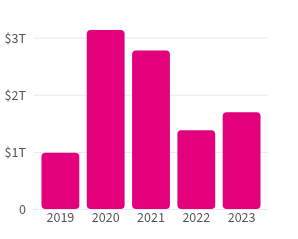

- Foreign aidIn FY 2024, the US promised $82.3B in foreign aid.Source: USAID and US Department of State

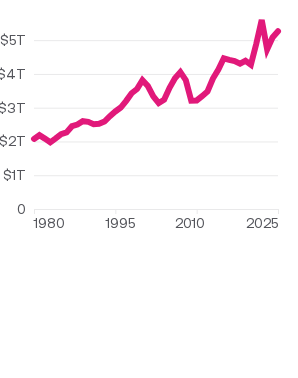

Deficit and debt

The federal government collects money—mostly through taxes—and spends it on various programs, with funds also flowing to state and local governments and to other countries as foreign aid.