Government spending

Which government programs does the Government Accountability Office consider inefficient?

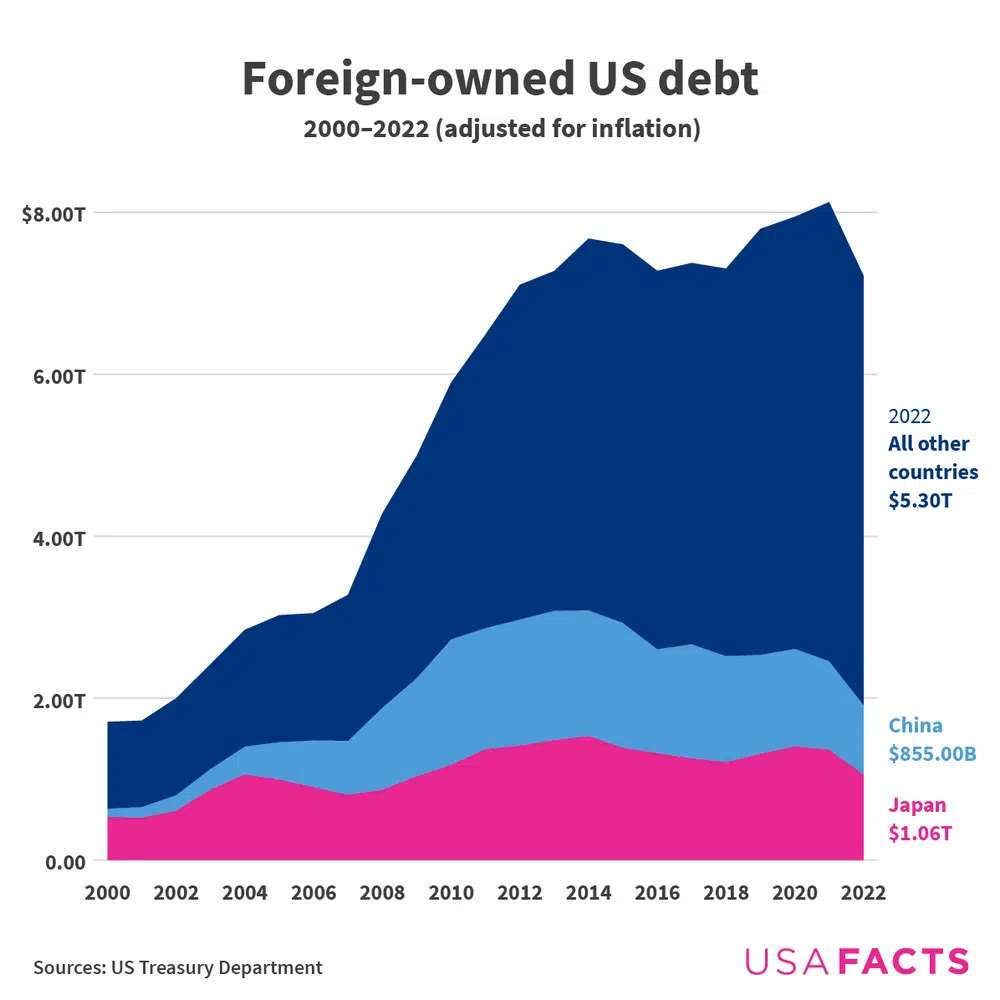

The US government owes trillions of dollars in debt to foreign entities, including governments, central banks, companies, and individual investors. This debt includes US Treasury bonds and other securities. Foreign ownership of US debt has shifted over time due to global economic events, national monetary policies, and other factors. Here’s an overview of which countries own the most US debt.

There’s more to explore in this article, including a chart where you can track the foreign holdings of US securities by dozens of countries dating back to 2011. Plus, here’s more on the strength of the US dollar.

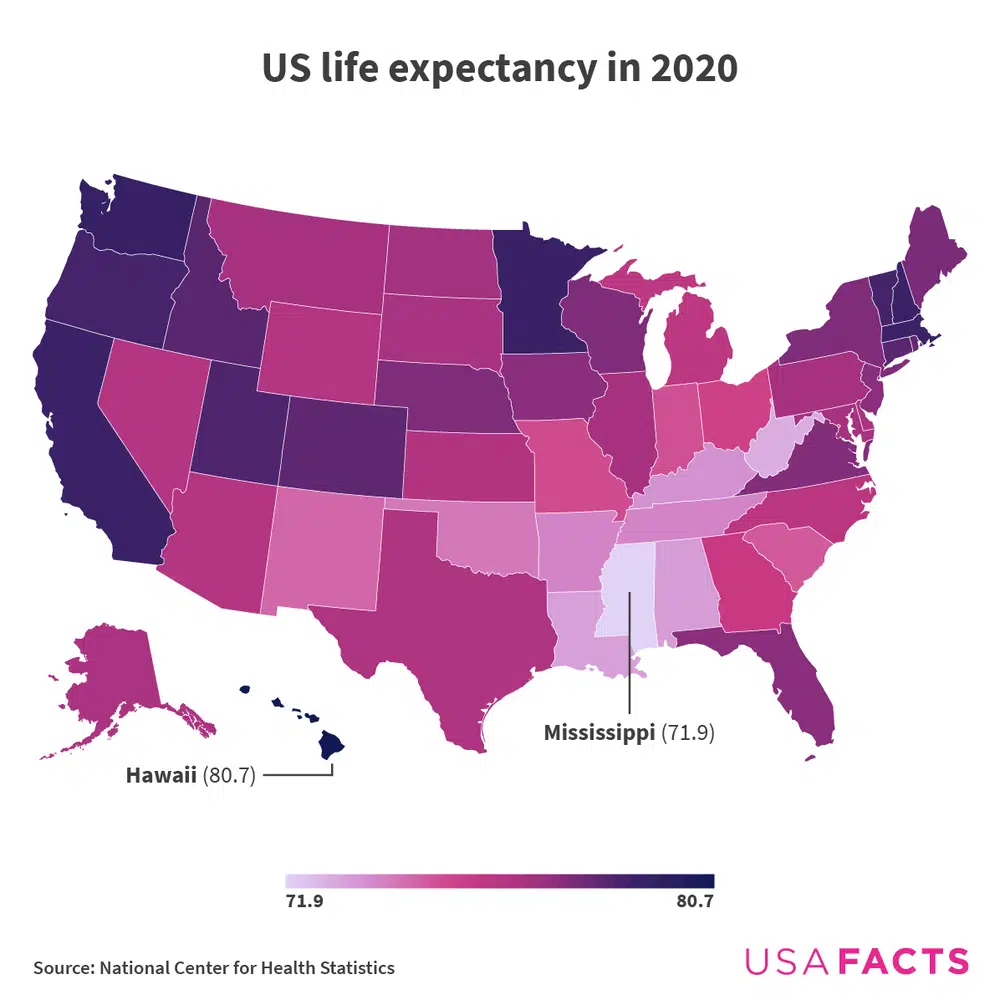

American life expectancy has fallen to a low not seen in decades. This new development partly reveals how COVID-19 affected life expectancy nationwide, but projections also differ depending on the state. See the differences between Southern states and Western states in this article.

How does the government define life expectancy? Get the answer here.

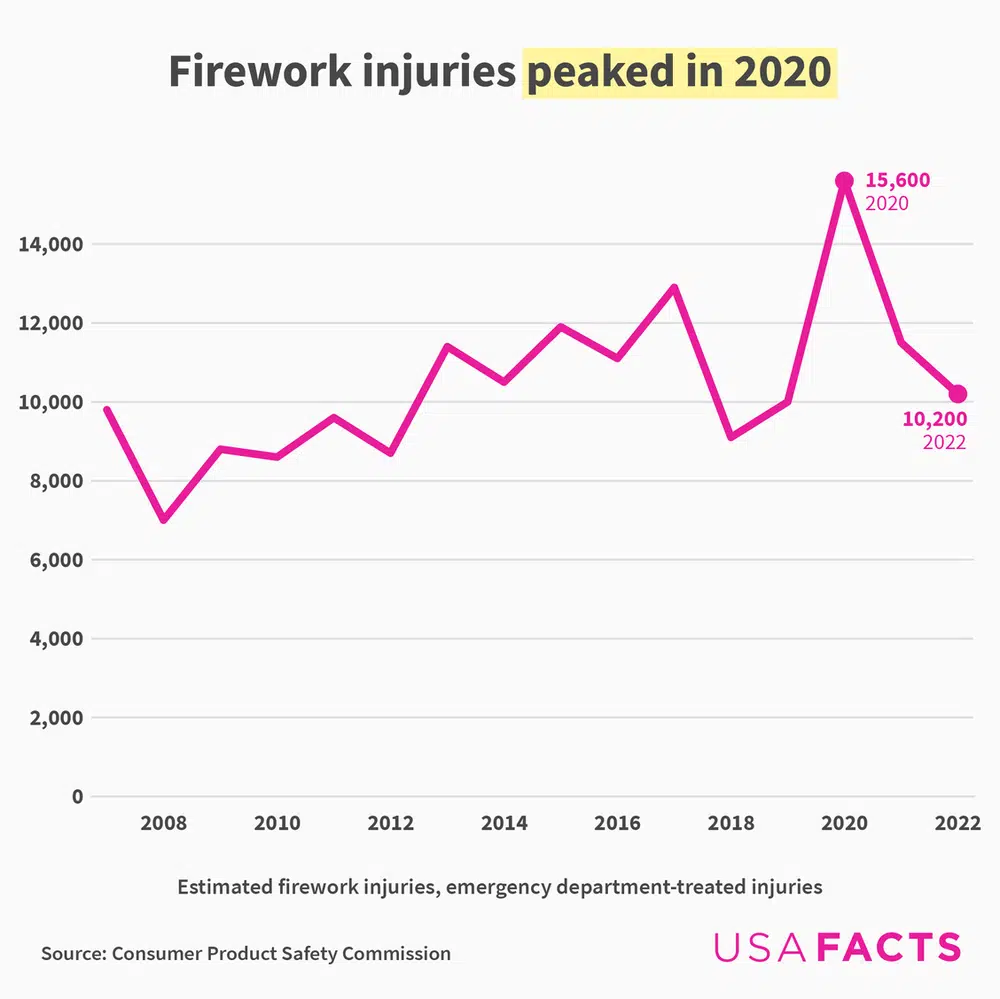

According to the Consumer Product Safety Commission, emergency rooms treated 10,200 people for firework injuries in 2022. Seventy-three percent of those injuries were in the weeks right before and after July 4. Eleven people died due to fireworks that year.

Newsletter

Keep up with the latest data and most popular content.