Government spending

Which government programs does the Government Accountability Office consider inefficient?

The Weekly Digest collects the most engaging data points and visuals from recent USAFacts stories. Dive into each report for more metrics, or skim here for a quick understanding of the numbers behind the news.

President Joe Biden recently signed the Inflation Reduction Act into law, investing $300 billion in deficit reduction and about $370 billion toward climate change programs and energy security. The climate programs include over $30 billion in incentives for companies to build wind turbines, solar panels, and batteries. This could further accelerate the nation’s leading source of renewable electricity: wind power.

Learn more about the contributions of wind power at USAFacts.org.

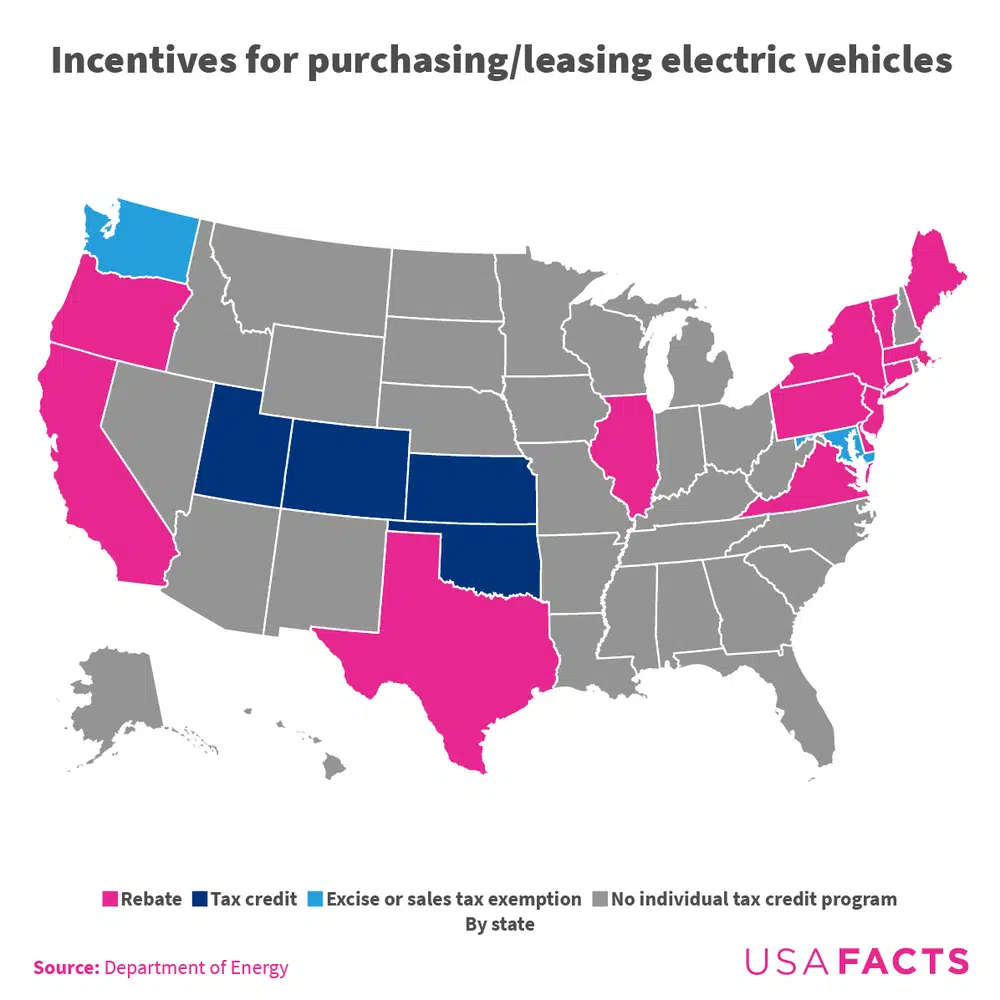

In 2019, 162,686 tax returns claimed the federal tax credit for electric vehicles — about 25% of qualified cars purchased that year. The Inflation Reduction Act expands the electric vehicle credit by removing the maximum limit that prevented owners of popular electric cars from receiving the credit and extending the credit to used electric vehicles.

Explore the other incentives available for electric vehicle buyers as well as potential additional fees.

Congress recently passed the CHIPS and Science Act of 2022, mainly referred to as the CHIPS Act. President Biden signed it into law on August 9. It is a $280-billion spending package to encourage growth in the US-based semiconductor industry. Here's some of what it includes:

What products are semiconductors used to produce? Where are semiconductor firms located in the US? Find out here.

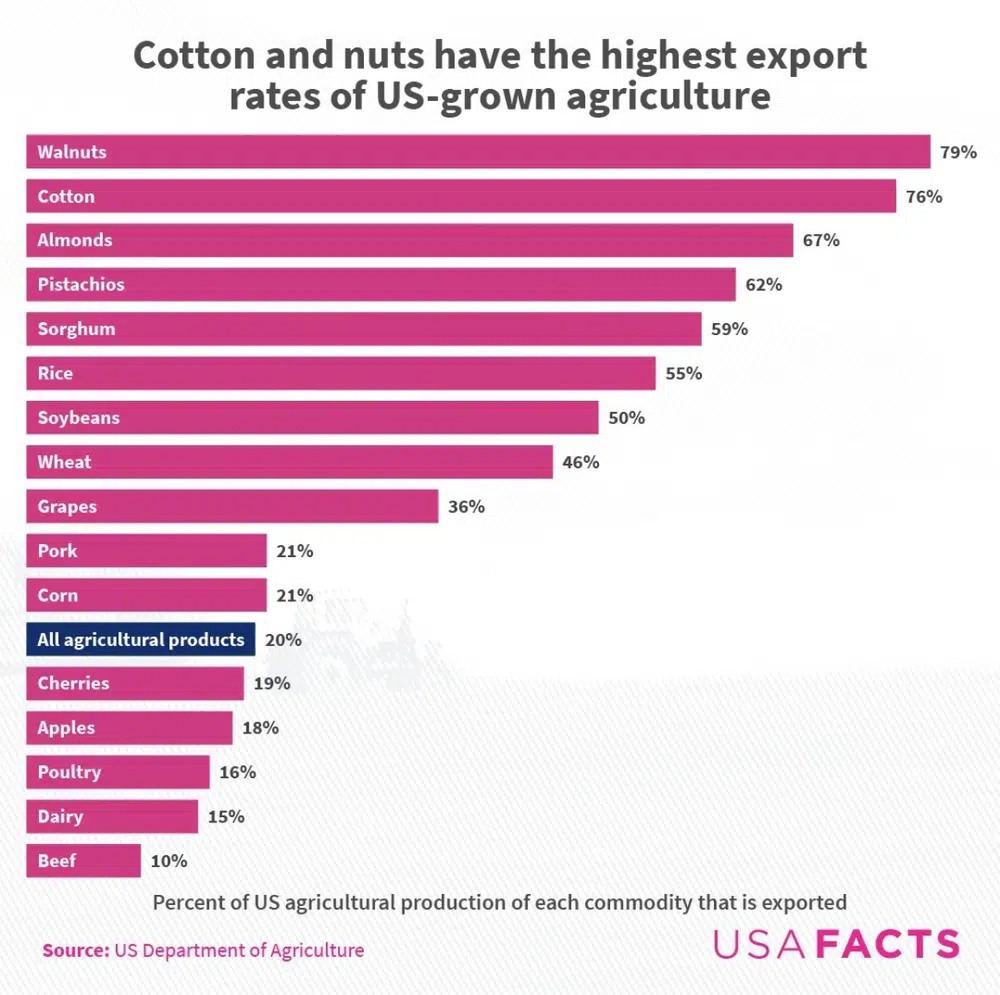

Of all US-grown agriculture, nuts and cotton are exported at the highest rates: 79% of walnuts, 76% of cotton, and 67% of almonds. Explore what else happens to the food grown in the US in this article.

Newsletter

Keep up with the latest data and most popular content.