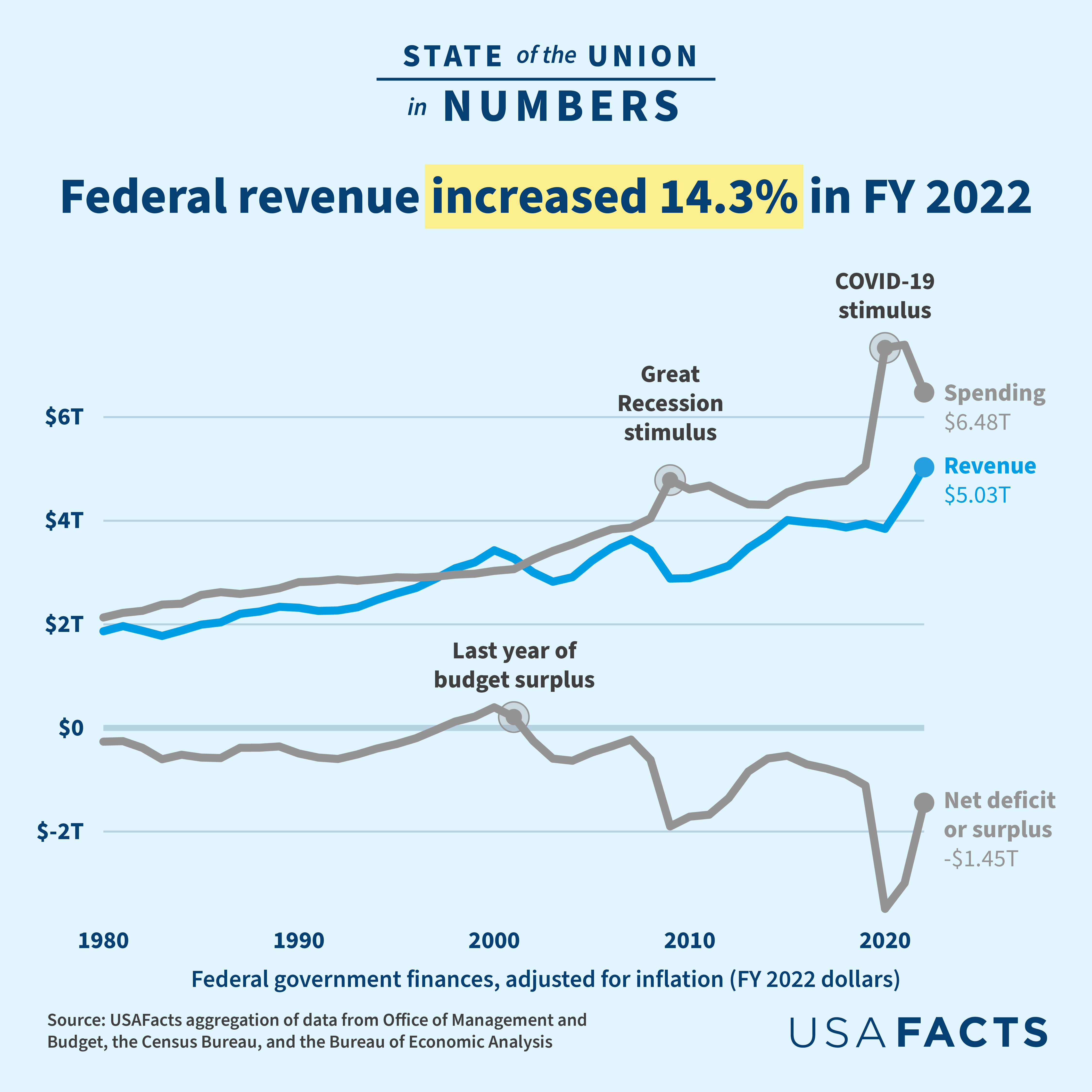

The US collected $5.03 trillion in federal revenues in 2022, up $630 billion from the previous year, after adjusting for inflation.

That equates to $15,098 collected per person, up 14% from 2021. Most revenues came from individual income tax, at $7,898 per person on average, and payroll taxes, at $4,510 per person on average.

Using data from the State of the Union in Numbers, this chart visualizes how revenues have grown over the past two years.

This growth rate represents the greatest annual increase in federal revenues and the second greatest year-over-year growth since at least 1980.

To make that $5.03 trillion more tangible, USAFacts broke it down to a per-person level. These numbers do not represent the US population; the numbers vary by person. Income and payroll taxes can vary across income brackets. Certain revenue sources, such as customs duties and corporate taxes, don’t affect all taxpayers. These averages provide an overall idea of how much the federal government collects per person.

How many individual tax returns does the IRS process each year?

The IRS processed 164,997,000 individual tax returns in 2022, and 166,898,000 individual tax returns in 2021. These numbers include tax returns received in the prior year and processed in the reported year.

Federal revenues broken down per person

The US primarily generates revenues from taxes. Americans contributed an average of $15,098 per person to federal revenues in 2022. This is nearly double what Americans paid 40 years ago after adjusting for inflation. The federal government’s main revenue sources include:

- Individual income taxes, which are collected on the money people and businesses earn through work. In 2022, the government collected an average of $7,898 in individual income taxes per person, the largest source of federal revenues.

- Payroll taxes, which are collected from a worker’s wages and salaries. In 2022, the government collected an average of $4,510 in payroll taxes per person, 72.7% of which went to fund Social Security, 23% to Medicare, and 4.3% to unemployment insurance, and other social programs.

- Corporate income taxes, which are collected from a corporation’s profits. In 2022, the government collected an average of $1,275 in corporate taxes per person.

- Custom duties, which are collected on imported goods. In 2022, the government collected an average of $300 in custom duties per person.

- Sales and excise taxes, also known as consumption taxes, which are collected from the sale of goods and services, with excise taxes targeting products such as fuel, cigarettes, and gasoline. In 2022, the government collected an average of $263 in sales and excise taxes per person.

- Other revenue sources such as the sale of government resources, royalties from leasing federal land, fines, penalties, and more. The government collected an average of $853 in other revenue streams per person in 2022.

Federal revenues per person by source, FY 2022

| Federal revenue source | Revenue, 2022 FY dollars |

|---|---|

| Individual income tax | $7,998 |

| Payroll tax | $4,510 |

| Corporate income tax | $1,275 |

| Custom duties | $300 |

| Sales tax, excise tax | $263 |

| Other | $853 |

According to a Congressional Budget Office report, the growth in federal revenues in 2022 came from sizable increases in the collection of individual income taxes, though revenues are expected to decrease over the next few years.

Roughly 40%–50% of federal revenues come from income taxes, despite recent changes to the tax code.

Additionally, while custom duties have accounted for a small portion of federal revenues, they have doubled since 2018.

How has the federal government funded itself over time?

The ratio of revenues generated by these sources has stayed relatively stable over the past 40 years, however, this has not always been the case.

During the 18th and 19th centuries, the US funded federal operations via customs duties, selling federal lands, and excise taxes.

After briefly using income taxes from 1862 to 1867 to help pay Civil War expenses, the federal government codified income taxes in the 16th amendment in 1909. This amendment states “Congress shall have power to lay and collect taxes on incomes.” With the Revenue Act of 1940, Congress permanently increased US income tax rates to pay for the costs of World War II.

Rising economic activity in the post-war period, coupled with tax code changes in the 1960s led to income and payroll taxes comprising bigger portions of federal revenues while less came from corporate, sales, and excise taxes.

Over the past 20 years, the nation has implemented several tax reforms in response to the growing federal deficit and recessionary periods such as the Great Recession and the COVID-19 pandemic.

Signed by former President George W. Bush, the Economic Growth and Tax Relief Reconciliation Act of 2001 reduced income tax rates and expanded tax-deductive contributions and credits.

Congress passed the Jobs and Growth Tax Relief and Reconciliation Act in 2003, reducing the long-term capital gains tax from 20% to 15%, along with various cuts to dividend, estate, and income tax rates.

On January 2, 2013, former President Barack Obama signed the American Taxpayer Relief Act of 2012 into law, lowering tax rates for Americans earning less than $400,000 per year while increasing the top marginal tax rate for all other individuals.

Most recently, the Tax Cuts and Jobs Act of 2017, signed by former President Donald Trump, reduced the corporate tax rate from a maximum of 35% to a flat rate of 21%, along with other tax reforms.

To get a full picture of the US government revenue and spending, and get the data directly in your inbox by signing up for our newsletter.

Keep exploring

Page sources and methodology

All of the data on the page was sourced directly from government agencies. The analysis and final review was performed by USAFacts.

USAFacts

State of the Union: Budget

Office of Management and Budget

Historical Tables, Budget of the United States Government