How are Americans doing financially?

In 2024, nearly a third of US adults felt they were worse off than in 2023.

More than a quarter of US adults say they’re struggling financially: 73% of Americans reported “living comfortably” or “doing okay,” according to October 2024 survey data from the Federal Reserve. Another 27% said they were either “just getting by” (19%) or “finding it difficult to get by” (8%).

The share of people who say they’re doing okay or better is two percentage points lower than pre-pandemic levels, and the lowest since 2016.

73% of Americans reported they are at least “doing okay” financially in 2024.

Share of individuals that report "doing okay" or "living comfortably", by year

This data is based on self-reporting in a survey rather than direct financial information. That said, there are trends based on demographic characteristics of respondents.

Do Americans feel better or worse off financially than before?

The Federal Reserve tracks whether Americans feel like their financial situations have improved or worsened from the year before. In 2024, 29% of the people surveyed felt they were worse off than the previous year. This is down from 35% in 2022, but still six points higher than the 23% of people who reported feeling better off than a year ago.

From 2014 to 2021, more Americans felt their financial situations were improving than worsening. Since 2022, the opposite has been true.

In the last three years, more Americans feel worse off financially than feel better off.

Reported financial situation of adults compared with 12 months prior, by year

What do Americans say are their main financial challenges?

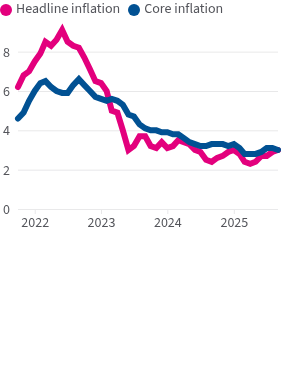

Over the past three years, more respondents cited inflation as the number one reason for their financial difficulties. Inflation hit a 40-year high of 9.1% in June 2022 and has yet to return to the Fed’s target of 2%.

After inflation, Americans pointed to the costs of basic living expenses and housing as their top financial challenges.

From 2016 to 2024, inflation became the primary self-reported financial challenge.

Change in percentage reporting main financial challenges, 2016 vs. 2024

Does education impact financial security?

Adults who’ve completed higher levels of education were more likely to feel financially secure. In 2024, 87% of people with at least a bachelor’s degree reported doing at least okay. That dropped to 68% for people with some college or a technical or associate’s degree, and 64% for people with high school diplomas or GEDs.

The group with the lowest rate of reported financial security was people who didn’t finish high school: less than half reported doing okay.

The share of adults reporting financial security increases with education.

Share of adults who report at least doing okay financially, by year and education

Do some racial groups feel better off financially than others?

Over the 12 years of available data, Asian adults consistently reported the highest rate of financial security, followed by white adults. Black and Hispanic adults reported the lowest rates.

The share of Black Americans who said they were doing at least okay declined from 68% in 2023 to 65% in 2024, while other racial groups stayed the same or increased.

Hispanic and Black adults report lower levels of financial security.

Share of adults who report at least doing okay financially, by race/ethnicity

Do parents feel they’re doing okay financially?

Parents with children at home report a more difficult financial picture, and the gap between them and adults without children has widened: In 2024, 65% of parents thought they were doing at least okay, compared to 76% of all other adults.

The gap hit 11 points two other times during the last ten years, in 2020 and 2023. By comparison, in 2021, the gap was 4 points.

The gap between financial comfort of parents vs. all other adults has grown

Share of adults who report at least doing okay financially, by year and parental status

Learn more about the average income of a US household, why Americans aren't saving as much as they used to, and get facts delivered to your inbox weekly by signing up for our newsletter.