Budget deficit definition

A budget deficit occurs when, within a single fiscal year, the government spends more money than it collects in revenue.

A budget deficit occurs when a government’s annual spending (also called “outlays”) exceeds its annual revenue (“receipts”). In other words, the government spends more money than it collects through taxes and other income sources in a given fiscal year. To cover this shortfall, the government borrows money, which increases the national debt.

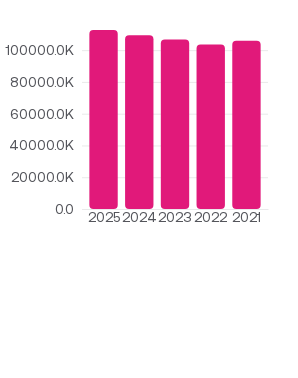

The US government borrows money by issuing debt securities (Treasury bills, notes, bonds, and inflation-protected securities) through the Department of the Treasury (TREAS). The Treasury sells these securities to various entities and individuals, both within the US and abroad.

When the government takes in more money than it spends in a fiscal year, it records a budget surplus, the opposite of a deficit.

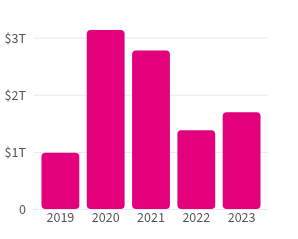

The size of the national deficit or surplus depends on both the economy and government policy. Strong economic growth raises tax collections through higher incomes and business activity, while recessions reduce them. Spending increases in Social Security, healthcare, defense, or emergency relief also drive deficits higher. For example, despite rising revenues during the COVID-19 pandemic, emergency unemployment and healthcare spending expanded the deficit.

What is the difference between debt and a budget deficit?

A budget deficit is the shortfall between spending and revenue in a single year.

The national debt is the total amount the government owes, built up over time from past deficits (minus any surpluses).

Think of the deficit as this year’s shortfall, while the debt is the accumulation of all past shortfalls, plus any accrued interest.

When was the last time the US did not have a deficit?

The nation last ran a budget surplus in 2001. The federal budget has been in deficit every year since 2002.