How do tariffs affect trade?

In 2024, the US imported $4.1 trillion and exported $3.2 trillion in goods and services. Higher tariffs can raise prices and the impact on US jobs is a complex issue. Join Steve as he talks through US trade, tariffs and their impact, US trade partners, trade agreements, and more.

Up Next

Transcript

President Trump says tariff is the most beautiful word in the dictionary. In this video, we're going to give you some facts and some data to try to form your own point of view by answering three big questions. What does the United States trade? Who do we trade with and what tools and rules do governments use to manage trade?

Hi, I'm Steve Ballmer. I spent 34 years growing Microsoft, ten years owning the LA Clippers basketball team. I love computers, data and facts. That's why I started USA Facts to help understand what our government is up to and what's going on in America. I'll share with you the facts and data, all from our government. You make up your own mind.

In this episode of Just the Facts, trade and Tariffs. But first, a quick disclaimer. As I talk. I do a lot of rounding of numbers, but the data you see on screen will be more exact. So now let's roll.

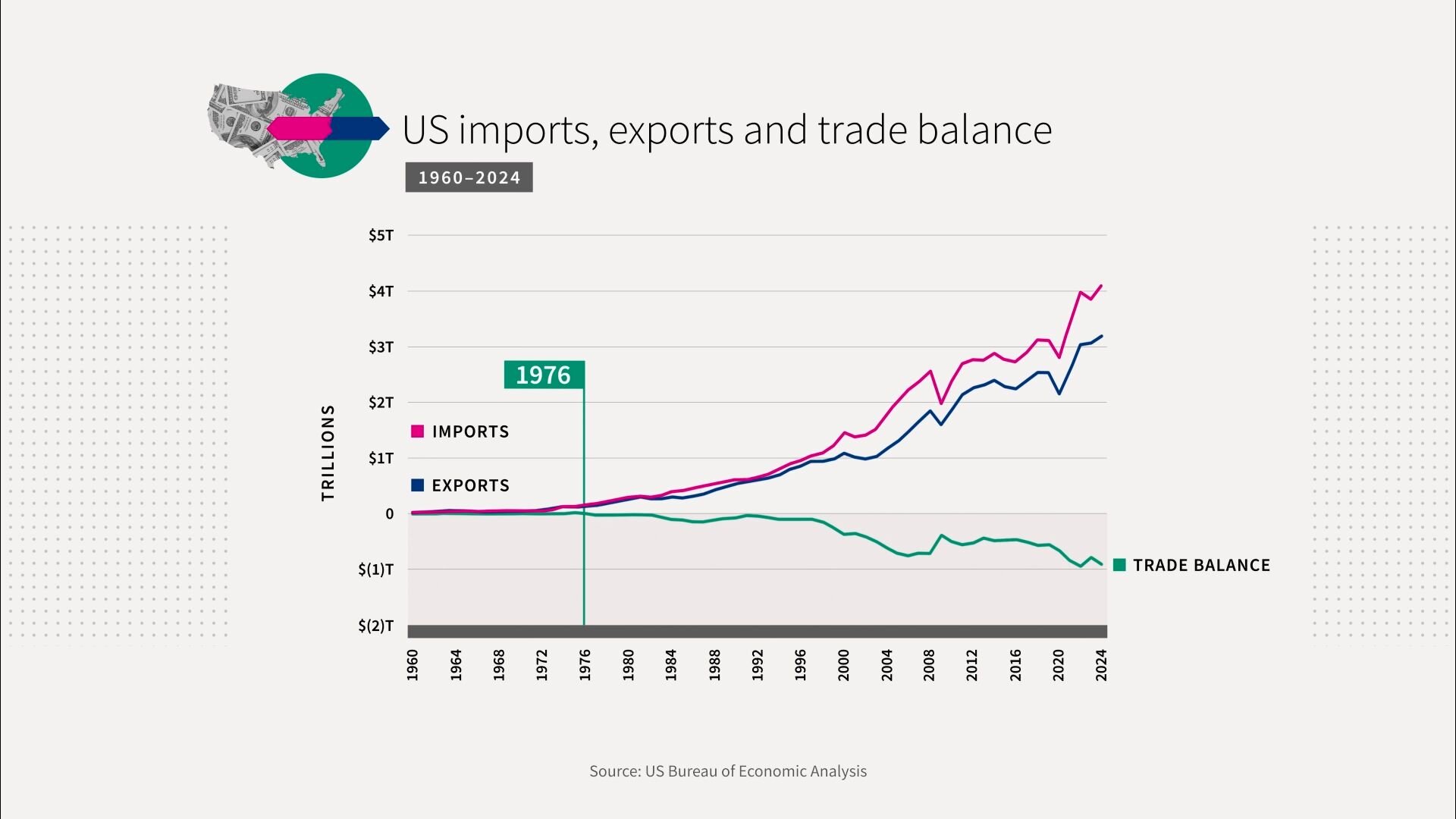

In 2024, the U.S. imported a total of $4.1 trillion of goods and services, and we exported 3.2 trillion

Trade policy set by the federal government can significantly impact what is traded and how trade is taxed or subsidized. More on that later. For now, let's look at what America buys from and sells to other countries.

Trade can be broken up into two categories: goods and services. Goods are physical things that you can touch and hold. Services are actions or work people do for others, such as medical services, insurance, accounting, and much more.

In 2024, the U.S. imported $3.3 trillion of goods. Goods are over 80% of our total imports.

As a comparison, our total gross domestic product, or GDP, is 29.2 trillion.

And our top three categories of goods imported were, in order, capital goods: these are long term assets that businesses use in the production process. Things like machinery, computers, and others. Second, consumer goods like household and kitchen appliances. Who knew? And third, industrial supplies. Things businesses regularly consume, with petroleum actually taking up the largest share of this category.

Guess what our biggest fruit import is? It is avocados. Our top vegetable import is tomatoes and cashews are the top nuts.

The U.S. also imported $812 billion of services

Services are about 20% of total imports, and our top three service imports were, number one, travel, which really is spending by U.S. residents abroad for accommodations, food and other expenses.

Economists call travel an import because we are sending our money outside of the country. So if an American goes to a museum in Paris, that's an import, as far as government accounting is concerned.

That's followed by business services, including professional and management consulting, research and development, and technical business services. The third biggest import is transport.

Now let's look at exports. The U.S. exported $2.1 trillion of goods, representing two thirds of our total exports.

Our three biggest exports? Number one, industrial supplies, with petroleum as an export being one of the biggest. Yep. We both import and export oil depending on the economics of where it is found, how it is shipped, and actually what type of oil it is.

For more on this, check out the video on energy and the environment. Number two is capital goods and three, consumer goods. As for exports of horticultural products, I just love saying that, the top fruit is apples, the top vegetable is soybeans, and the number one nut is almonds, again. How about a little almond milk? Why not?

This is a smoothie ready for export.

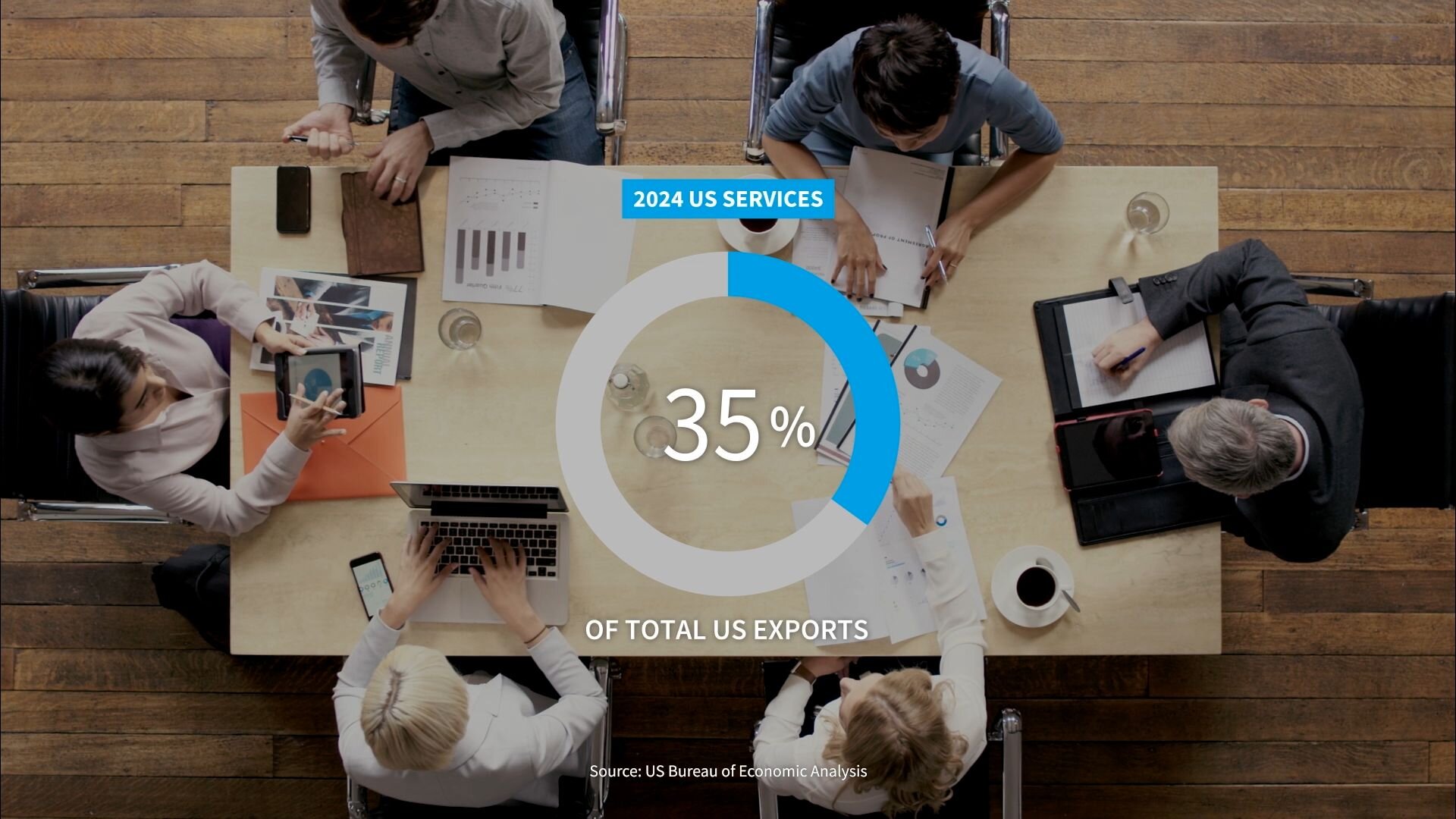

Finally, the U.S. exported $1.1 trillion in services, a third of our total exports.

The top three services being: business services, travel again - now, in this case, that's all the things foreign visitors spend money on when they visit us, and third is financial services like those offered by banks and the like.

Today, the United States has trade relations with more than 200 countries and territories.

Who do you think is America's biggest trading partner, measured by the amount of imports plus exports? China? Nope.

Mexico actually. Then Canada, China, the United Kingdom, Germany and Japan. Together, they account for nearly half of our trade.

Now, when any country sells more abroad than it buys from abroad, it has a trade surplus.

If a country buys more than it sells, it has a trade deficit.

The US has actually had a trade deficit every year since 1976. When we run a trade deficit, it means we are buying more from foreign countries than they are buying from us.

So US dollars are leaving the country to pay for those imports. Last year, the US had a $918 billion trade deficit, 17% higher than 2023.

In 2024, America's largest trade deficit was with China at $263 billion, followed by Mexico at $179 billion. With Canada, our trade deficit was $36 billion, and our trade deficit with the entire European Union was $161 billion.

Meanwhile, the US has trade surpluses with 25 trading partners. Some of the top trade surpluses are with Australia, Belgium, Brazil, the Netherlands, Saudi Arabia, Singapore, Hong Kong and the United Kingdom.

Trade, like most things in life, comes with trade offs. It might be interesting to understand, for example, why 96% of the shoes sold in the US are imported from abroad.

Suppose a U.S. company builds a factory in Vietnam. Vietnam gets the jobs. Now, US companies may make those decisions for a variety of reasons: to offer lower prices to U.S. consumers, to increase their own profits, maybe to improve the delivery time of products to citizens here in the United States.

Presumably, US consumers and corporations benefit, but the jobs do not end up in the United States. Sometimes governments step in to change trade somehow. To do this, they use three main tools: quotas, subsidies, and tariffs. A quota is a limit placed on an import to regulate the amount of merchandise imported during a specified period of time. The US, for example, sets limits on the amount of beef, dairy, sugar, tobacco, steel, and cotton that can be imported.

Subsidies are monetary payments and other types of government support for domestic producers, which help make them more competitive in the global market. For example, US companies can get low interest loans through the Export Import Bank. And there are similar programs that foreign governments use for their companies.

Another way to shape global trade is through tariffs. A tariff, just to remind you, is a tax levied by one country on goods and services imported from another country.

Now these tariffs actually apply differently to specific products. And they can be issued as a percentage of the total import bill, a fixed cost per unit, or a combination of both.

A simple example: a car part made in Canada comes in to the US, and let's suppose the importer pays $10 for it.

If the US imposes a 20% tariff on that product, then the importer will actually then pay $12 for it.

The Canadian manufacturer gets $10 and the US government gets $2. This increases the cost of these goods for consumers and company. President Trump said the higher the tariff, the more likely it is that the company will come into the United States and build a factory in the United States. There are trade-offs, though, in imposing tariffs. Potentially more jobs in the United States and potentially higher prices in the United States.The analysis of that is the business of economists.

Tariffs can also be used to achieve foreign policy goals. In 2024, the US taxed imports from Belarus, Cuba, North Korea and Russia at rates generally much higher than those of other countries, intending to deter trade with those nations.

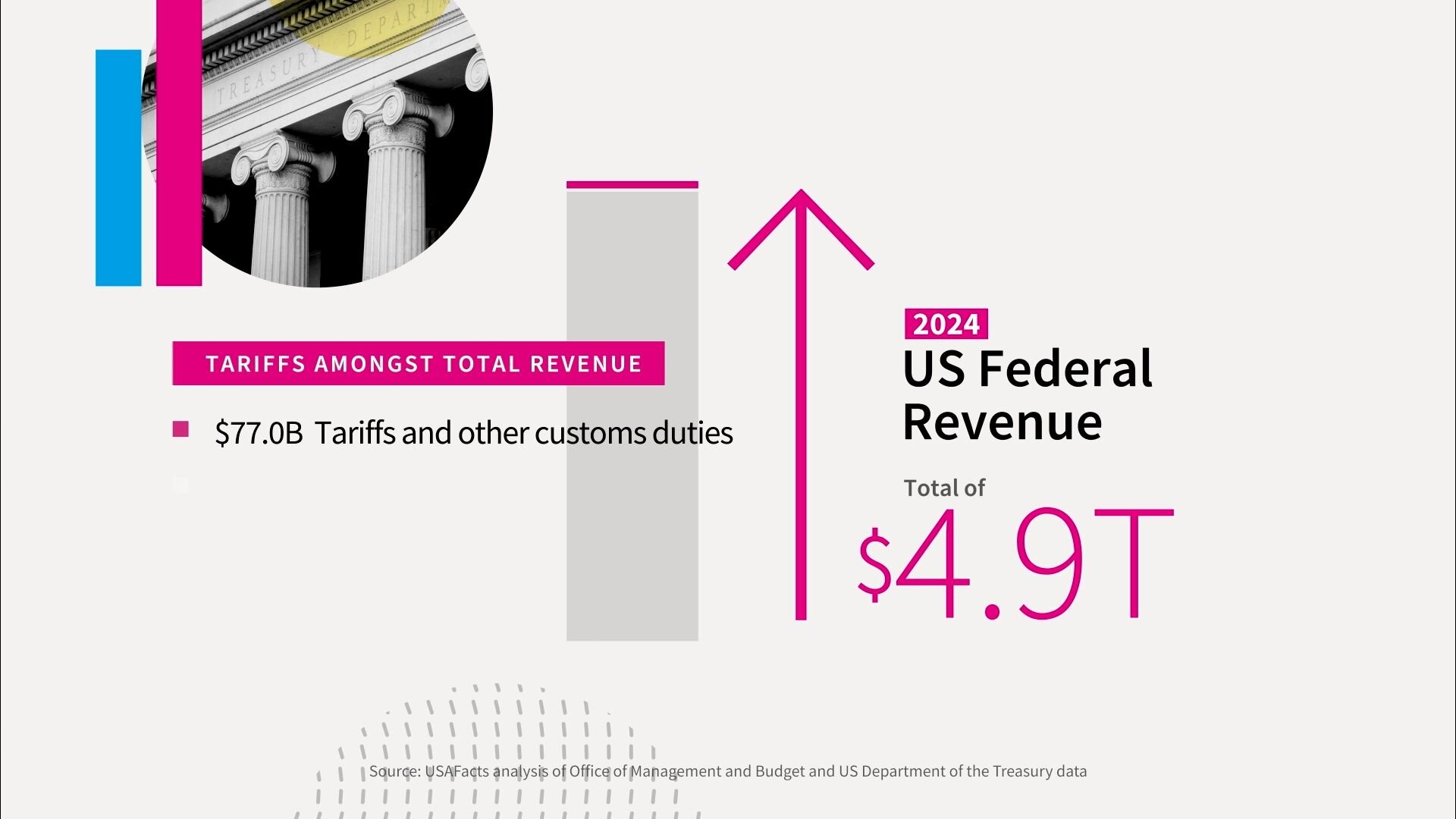

Finally, tariffs are a source of federal revenue. In the 19th and early 20th centuries, before the establishment of the income tax, tariffs were often the most significant source of revenue for the US government.

However, over the past 70 years, tariffs have rarely provided more than 2% of federal revenues, with most revenue coming from various taxes on individual and corporate income.

In 2024, the US government collected $4.9 trillion in total revenue. Of that, only $77 billion, or 1.6%, came from tariffs and other custom duties.

Here's a sample of goods that come into the United States and the tariffs they are subjected to:

- Basketballs - a 4.8% tariff.

- Soybeans - they come in for free.

- Corn can be as much as $0.25 per kilogram.

- Petroleum - between five and a quarter and ten and a half cents per barrel.

- Smartphones come in without tariffs.

- Blenders, 4.2%.

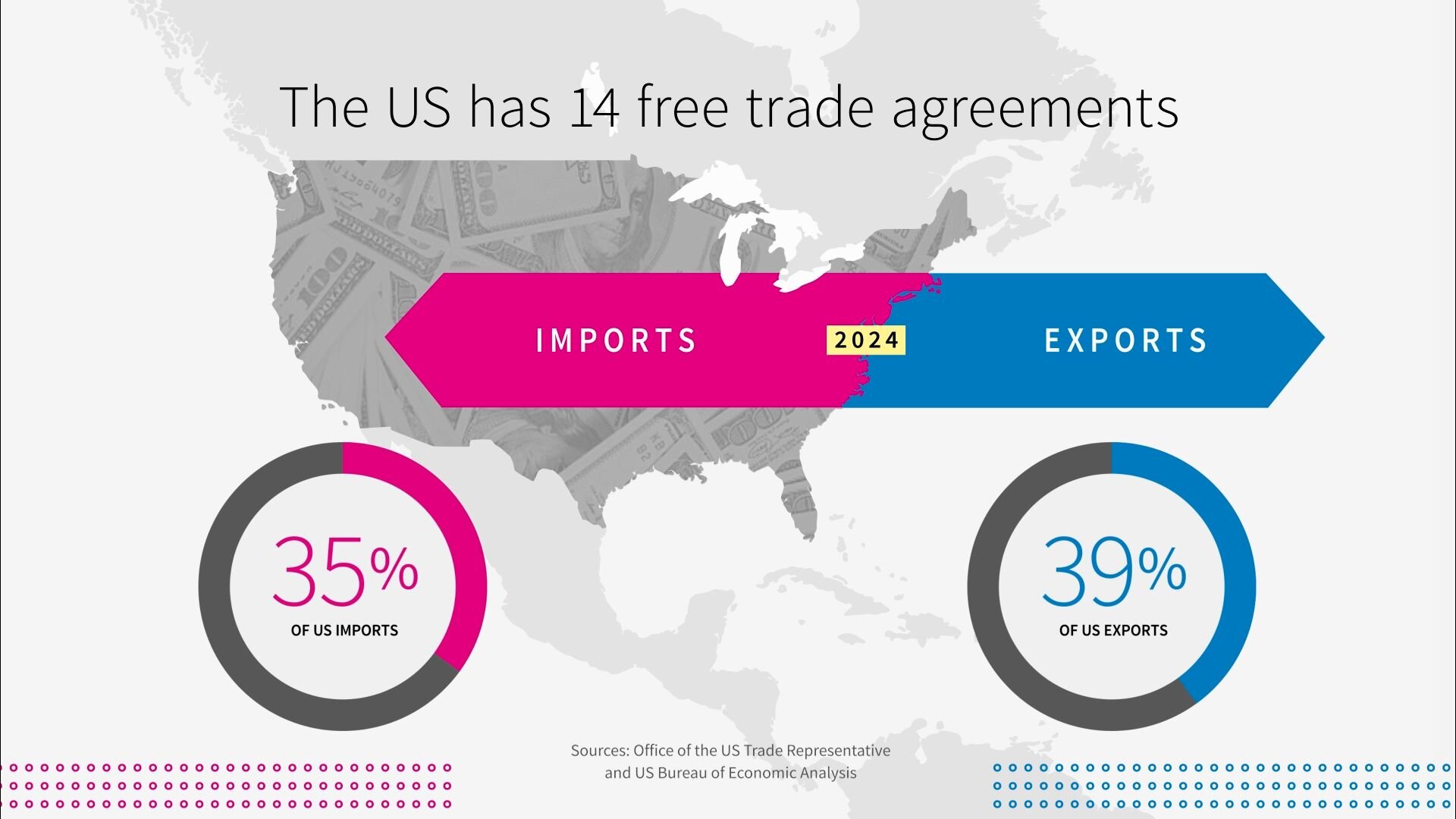

Some of these goods are eligible for reduced or free rates, though, if they come in from countries with which we have trade agreements.

All of these rates, and many others, have complex political and policy reasons behind them, and plenty of lobbyists arguing for both sides, at any rate. Ultimately, a country's tariff rates depend on its trade relationship with the US. The US is one of 166 member nations of the World Trade Organization, or WTO, which was created in 1995 to liberalize and set basic rules for international trade and to provide a forum for trade negotiations and dispute resolution.

However, the WTO allows many exceptions to its rules, including measures to ease the burden on developing countries or to respond to certain other trade practices. Member nations can also establish free trade agreements with one another, typically designed to reduce trade barriers and facilitate more trade. The US has 14 free trade agreements with 20 trade allies, which receive about 39% of all our exported goods and account for 35% of everything we import.

In recent years, many goods originating in Canada and Mexico have commonly qualified for free or reduced duties due to the United States-Mexico-Canada agreement, or the USMCA, which President Trump signed and went into effect in 2020.

However, that began to change in early 2025 when President Trump started imposing tariffs on Canada, Mexico and China. As of this recording, some levies have begun and some have been delayed.

In 2024, about 70% of all products entered the United States duty free, meaning they were not subject to tariffs.

Companies importing goods from international trading partners are supposed to pay the tariff fees to U.S. Customs and Border Protection at the port of entry within ten days. Now, of course, other countries also impose tariffs on many of our goods, for many of the same reasons the United States does.

Economists will speculate over which countries might benefit most from the tariffs we impose versus the tariffs they impose. But what is the impact of trade and tariffs on prices and jobs? Here's an area where federal government data doesn't always paint a very clear picture. Our leaders in Washington would do all Americans a favor by improving it.

The US International Trade Administration did estimate that as of 2022, exports directly and indirectly support about 10.2 million jobs.

There's no official government data on the role of imports in keeping jobs in the United States. As for prices, a 2020 Bureau of Labor Statistics study suggests that higher tariffs indirectly raise domestic prices of goods as the market forces shift the burden onto consumers, even as higher tariffs protect some U.S. jobs in some U.S. industries.

Other studies from the Congressional Research Service and the US International Trade Commission suggest that lower tariffs on foreign goods lead to lower prices and higher incomes for American consumers, even as they lead to job losses in some sectors and job gains in others.

So what's more important? Lower prices for U.S. consumers or more jobs for U.S. workers? And what role do tariff rates really play in shaping both priorities?

You have to decide what you think. These are the questions President Trump and Congress will need to confront amid major changes in US trade policy.

It might surprise you that the US Constitution gives Congress the power to regulate commerce with foreign nations and to lay and collect taxes, duties, imposts and excises, i.e., tariffs. That would suggest that Congress has the power to set tariffs.

But since the early 20th century, Congress has passed several laws delegating power to the president to unilaterally impose and adjust tariffs for different reasons, including to protect national security, safeguard domestic industries, and respond to other countries’ trade and tariff practices.

For example, President Trump has imposed tariffs on Mexico and Canada to stem the flow of migrants and drugs into the United States.

It's up to you to determine what you think of US trade and tariff policy. This is Just the Facts from USAFacts. You decide what you believe.

Page sources and methodology

All of the data on the page was sourced directly from government agencies. The analysis and final review was performed by USAFacts.

Bureau of Economic Analysis

Census Bureau

Our government is complex. Our data doesn’t have to be.

Subscribe to our weekly newsletter to get data-backed answers to today’s most debated issues