All about taxes

In FY 2024...

$2.4T

$1.7T

$530B

How does it all work? Let's peek behind the curtain

How do tax payments vary between income levels?

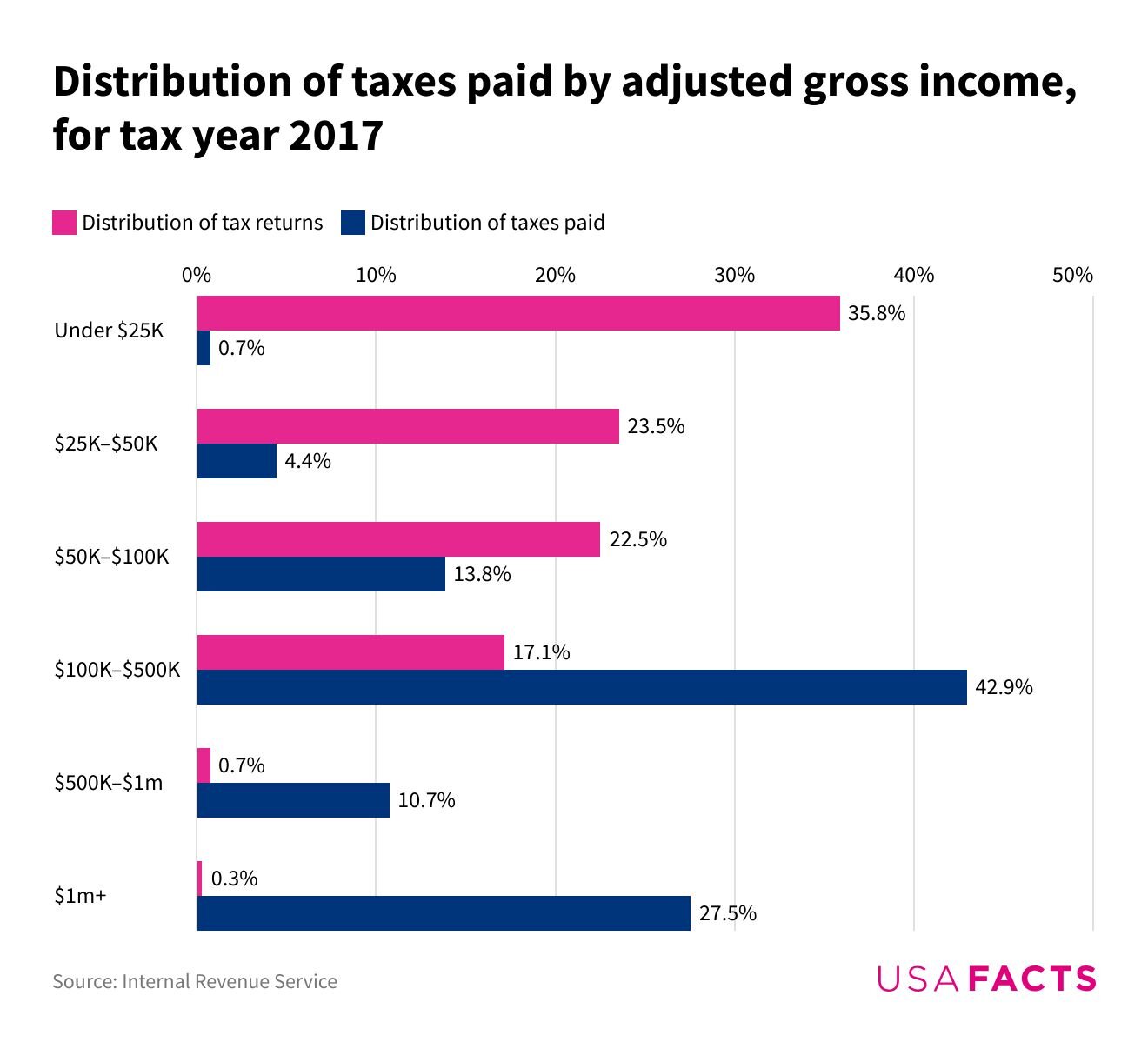

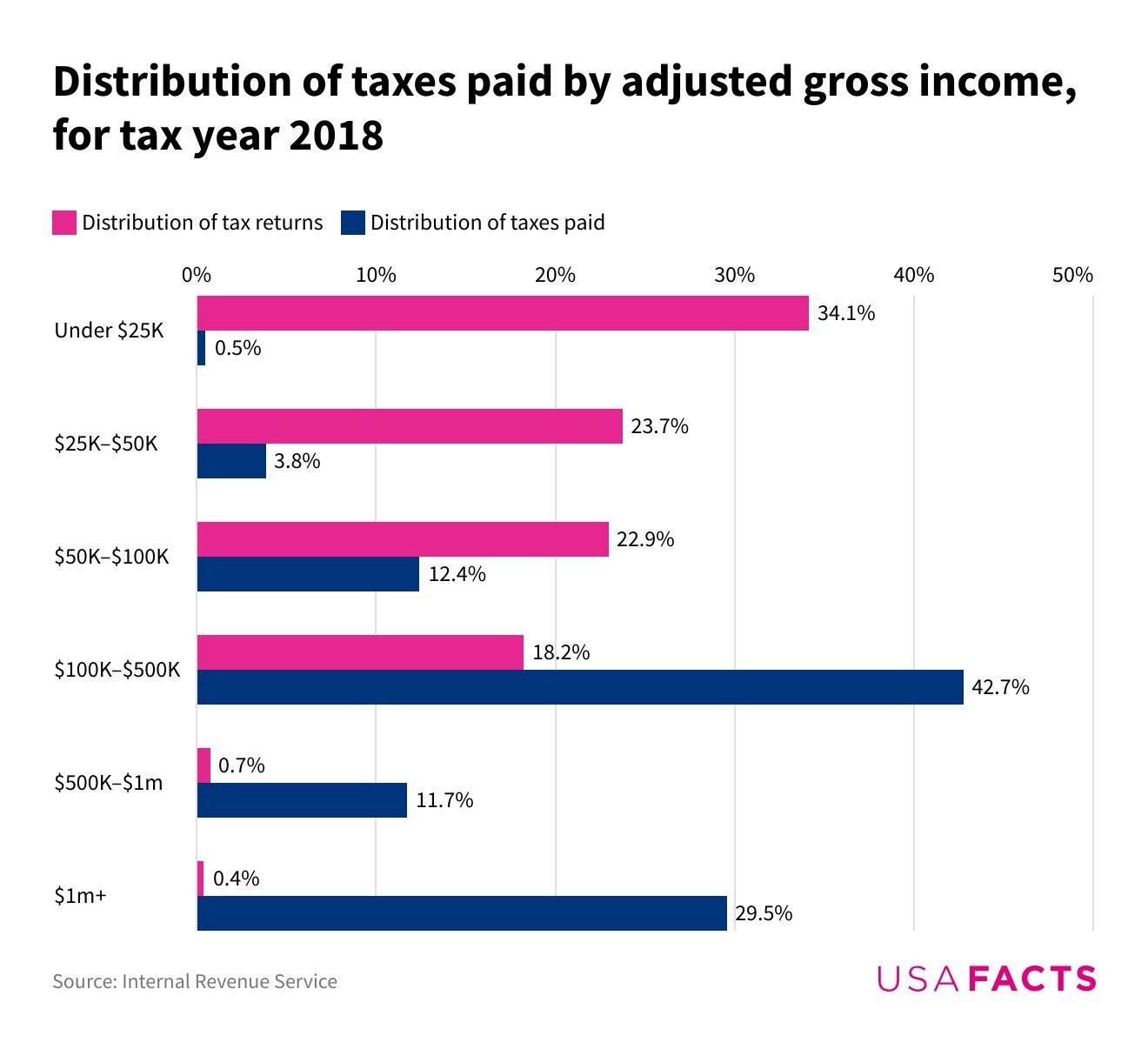

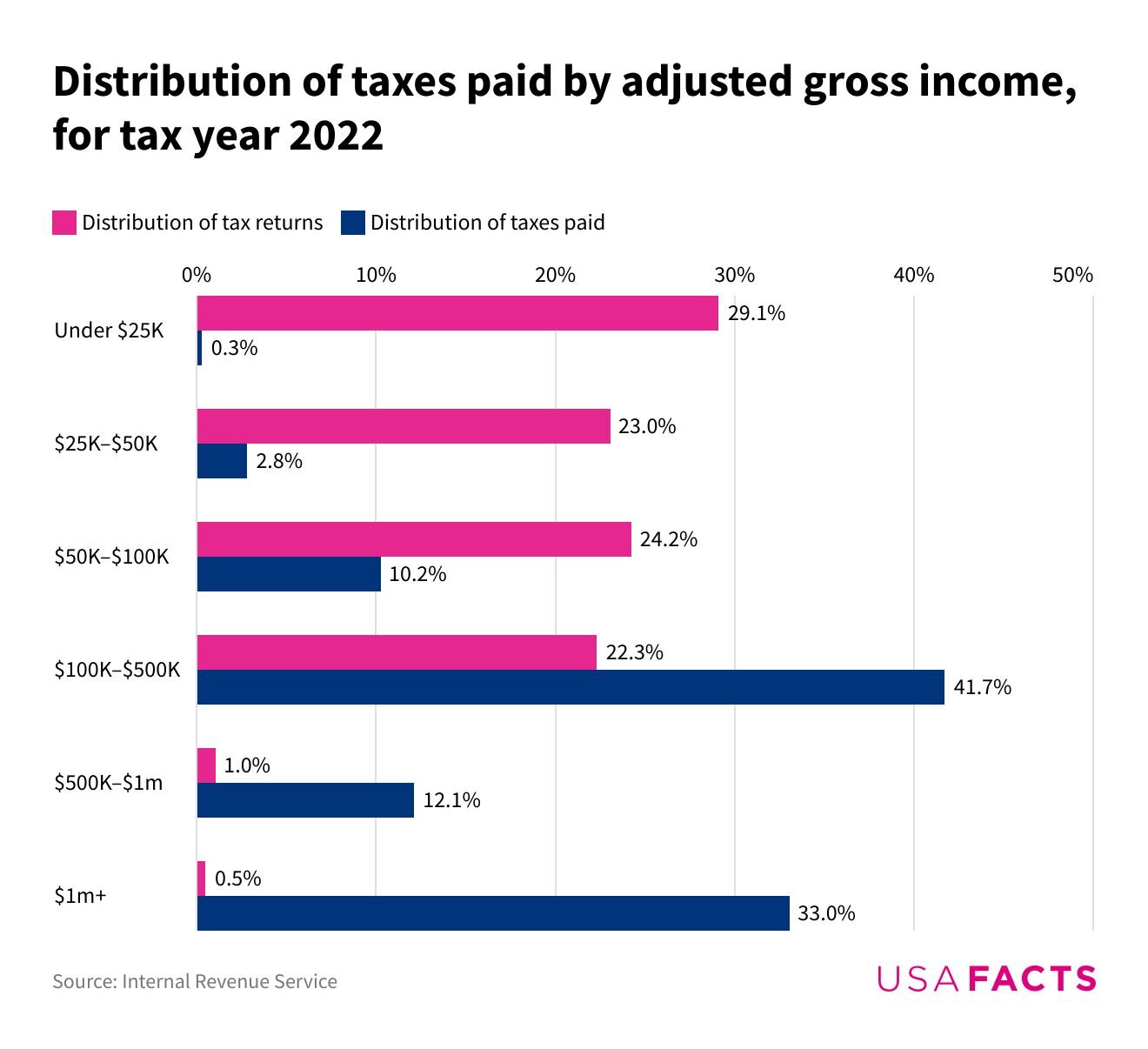

Effective tax rates have declined across income groups, but the portion of taxes paid by high income people has grown since TCJA was enacted in 2017.

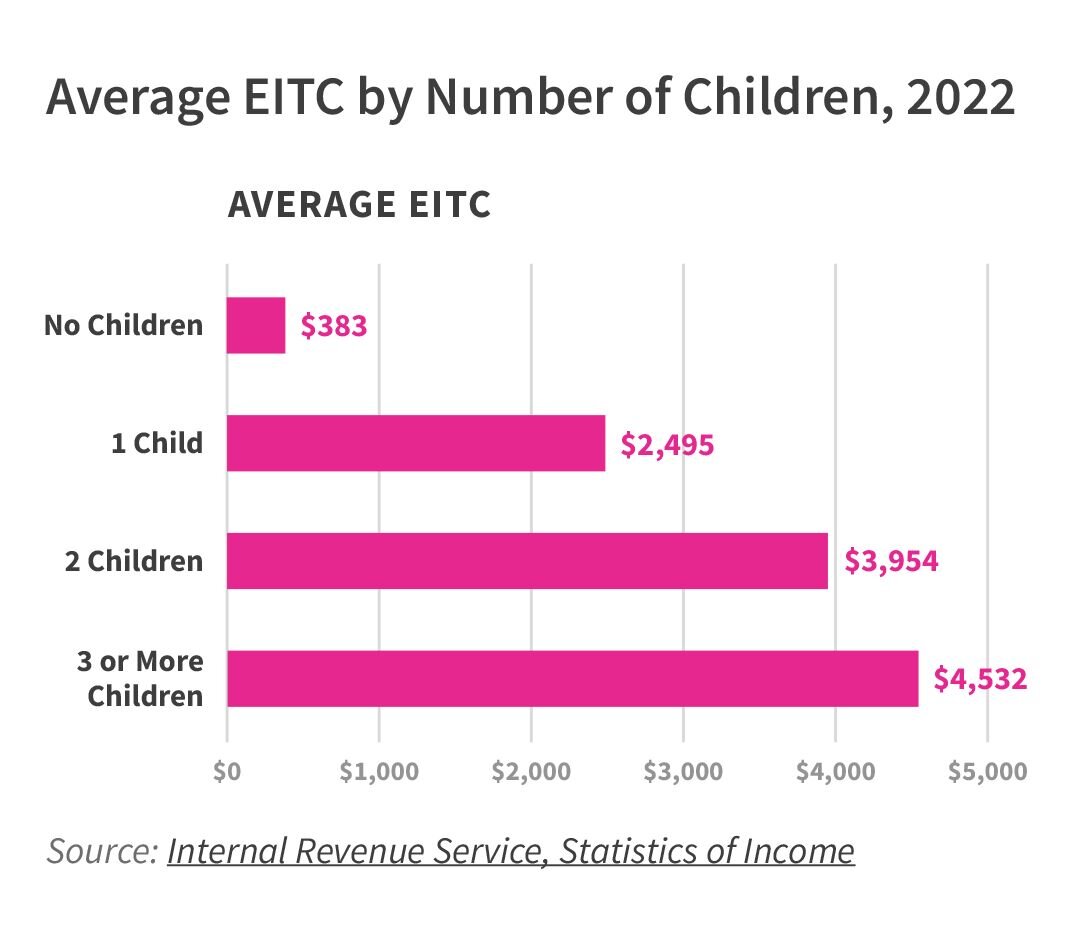

The Earned Income Tax Credit is designed to benefit low-income workers, particularly those with children. In 2022, 24.1 million tax returns claimed the EITC, and benefits totaled $60.1 billion.

Steve Ballmer explains the whole US tax system in 16 minutes

Who pays no federal income tax?

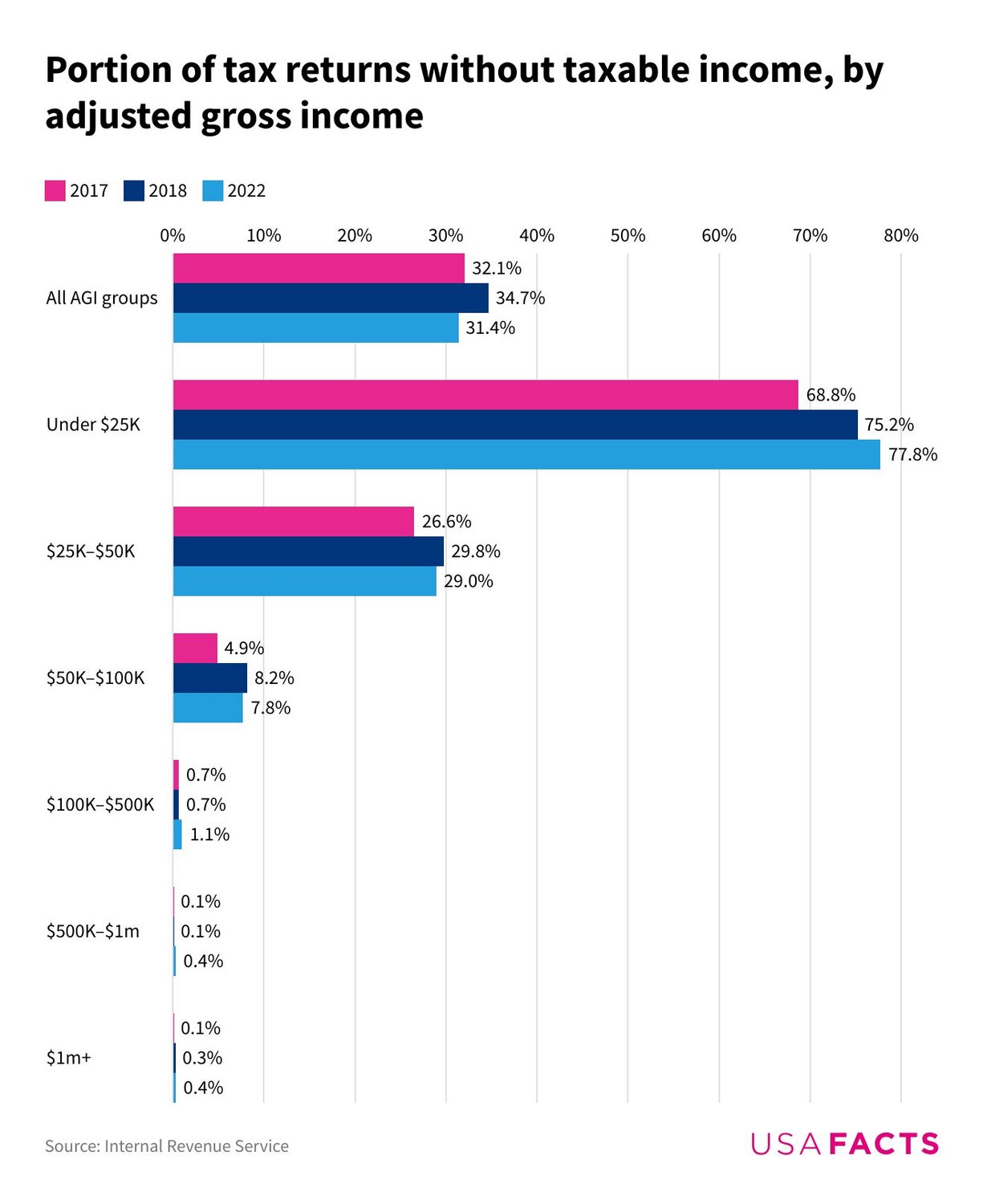

A large portion of people do not pay federal income taxes because they do not have federally taxable income after accounting for deductions.

In 2018, 34.7% of all tax returns did not have taxable income and, thus, did not pay federal income taxes, up from 32.1% in 2017. The portion not paying federal income taxes is concentrated among low-income people and grew after TCJA took effect.

How many people take SALT deductions?

The Tax Cuts and Jobs Act of 2017 introduced a $10,000 cap on the State and Local Tax (SALT) deduction while also nearly doubling the standard deduction. Since those changes took effect, the portion of individual tax returns claiming the SALT deduction has declined from 30.4% in 2017 to 9.3% in 2022.

Complete this line chart on the percentage of tax returns claiming SALT deductions. Take your best guess and press "I'm done" when finished.

Want to know as much as your congressional representatives?

Trends in itemized deductions since the Tax Cuts and Jobs Act

Among the many changes introduced by the Tax Cuts and Jobs Act of 2017 (TCJA), one of the most significant was nearly doubling the standard deduction and scaling back some itemized deductions.

How many people claim the state and local tax (SALT) deduction?

One of the largest itemized deductions in the tax code is the State and Local Tax (SALT) deduction. It allows taxpayers to reduce their federally taxable income by the amount they pay in state and local taxes, including property and income or sales taxes.

How did the Tax Cuts and Jobs Act impact pass-through entities?

In 2022, 15.9% of tax returns claimed the Qualified Business Income (QBI) deduction, collectively lowering their taxable incomes by $216.1 billion.