Which countries own the most US debt?

As of April 2024, foreign countries own approximately $7.9 trillion in Treasury securities — or 22.9% of total US debt.

The US government owes trillions of dollars in debt to foreign entities, including governments, central banks, companies, and individual investors.

This debt includes US Treasury bonds and other securities, which are popular as they are considered safe investments.

Many nations buy US Treasury securities (also called “Treasurys”) because they are considered one of the safest investment options available.

How much US debt do foreign countries own?

As of April 2024, foreign countries own approximately $7.9 trillion in Treasurys — or 22.9% of total US debt. Over the past two decades, central banks and other government entities have owned more than 50% of foreign-owned debt. Independent investors and companies held the rest.

At its peak in 2014, foreign-owned securities made up over a third of total US debt.

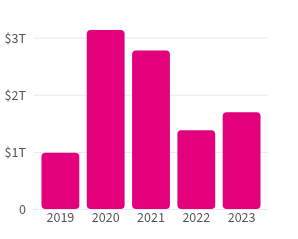

Total US national debt, separated by ownership, adjusted for inflation, 2000–2024

In 2000, $1.8 trillion, or 17.9% of total debt, was foreign-owned. By 2014, this grew to $8.0 trillion, or 33.9% of total debt — the highest percentage in US history.

Early in the pandemic, foreign ownership of US debt fell as countries such as Saudi Arabia, China, and Brazil sold their shares of US Treasurys for short-term capital. Though foreign countries resumed buying foreign debt by the end of 2020, total foreign-owned debt has since decreased.

Which countries hold the most US debt?

Over the past 20 years, Japan and China have owned more US Treasurys than any other foreign nation.

Between December 2000 and April 2024, Japan grew from owning $556.3 billion to just over $1.1 trillion. China’s ownership grew from $105.6 billion to $749.0 billion.

Japan and China have been the largest foreign holders of US debt for the last two decades.

Foreign-owned US debt, adjusted for inflation, December 2000–April 2024

Between 2003 and 2011, Japan and China held 44% or more of all foreign-owned US debt. However, this share has declined over time, and as of 2023, they controlled approximately 25% of foreign-owned debt.

Five countries hold about $3.3 trillion in US Treasurys — roughly 40% of all foreign-owned assets.

US foreign-owned debt by top five holding countries as of April 2024

As of April 2024, the five countries owning the most US debt are Japan ($1.1 trillion), China ($749.0 billion), the United Kingdom ($690.2 billion), Luxembourg ($373.5 billion), and Canada ($328.7 billion).

Investors from Russia, China, and Indonesia had sharp drops in US Treasurys over the last several years due to sanctions and short-term capital needs, among other reasons.

What types of debt do foreign countries hold?

The US offers two main types of debt: public and intragovernmental. Public debt is sold as Treasury bonds, bills, and notes to outside investors, including foreign governments. It funds various government activities and pays off older debts. Intragovernmental debt, on the other hand, is what the government owes to its own programs, like Social Security, Medicare, retirement funds, and more.

Foreign governments primarily purchase public debt because it's marketable and can be resold. In contrast, intragovernmental debt is mainly controlled by the US government, and isn't traded on the open market.

A majority of foreign countries own more US debt today than they did in 2011.

Foreign holdings of US securities by country, adjusted for inflation, December 2011–April 2024

Why do foreign countries buy US debt?

Foreign investors buy US Treasury securities because they're among the world's most secure assets.

The US government's commitment to timely debt repayment, especially during economic uncertainty, makes Treasurys a staple in many foreign monetary policies.

Holding a significant amount of US dollars can be advantageous because it is a widely accepted currency in international trade and transactions. Owning US Treasury securities can provide further benefits such as portfolio diversification.

Is there a risk in foreign countries buying US debt?

Foreign ownership of US debt introduces several risks that can impact economic stability.

Foreign entities holding significant amounts of US Treasury securities could potentially influence US economic policies. They might impact economic decisions or create instability by rapidly selling off their holdings, which could raise interest rates and disrupt financial markets.

The US is vulnerable to changes in the global economic landscape due to its reliance on foreign financing. Shifts in foreign economic policies, global financial crises, or changes in investor sentiment can lead to decreased purchases or accelerated selloffs of US debt, affecting US interest rates and financial stability.

Additionally, reliance on external financing to cover US deficits creates a dependency that may prove unsustainable. If foreign demand for US debt decreases, financing future deficits could become more challenging, potentially necessitating higher domestic interest rates to attract necessary capital.

This reliance on foreign capital to finance deficits necessitates a trade deficit, with the US importing more than it exports. This situation contributes to the national debt and could lead to economic imbalances that affect various sectors, potentially impacting jobs and industries within the US.

See the most recent statistics on foreign-owned debt and get data delivered directly in your inbox by signing up for our newsletter.

Keep exploring

Page sources

US Department of the Treasury

Portfolio Holdings of U.S. and Foreign Securities

Federal Reserve

Foreign Demand for US Treasury Securities during the Pandemic.