Tariff classification definition

Tariff classification is the process of determining the correct category for an imported good.

A tariff classification is the process of identifying and categorizing an imported good.

When goods are imported into the US, the importer must declare them to US Customs and Border Protection (CBP). As part of this process, the importer is responsible for correctly classifying the goods under the US Harmonized Tariff Schedule, assigning them a value, and providing accurate information so CBP can assess duties, collect trade data, and apply any restrictions like quotas or embargoes.

How is a tariff classification made?

Using the Harmonized Tariff Schedule (HS), an importer must determine which HS code applies to the goods in question. An HS code is a standardized, internationally recognized numeric code used to classify products in global trade, helping governments set tariffs, collect trade data, and enforce regulations.

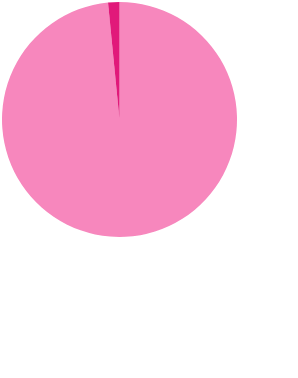

What happens if a tariff classification is incorrect?

An incorrect classification may lead to increased duties plus interest, if applicable. Negligence in tariff classification could lead to detention or seizure of the imported goods, with potential civil or criminal penalties.