What is the current inflation rate in the US?

2.4%

2.5%

Headline inflation was lower than core inflation in January 2026.

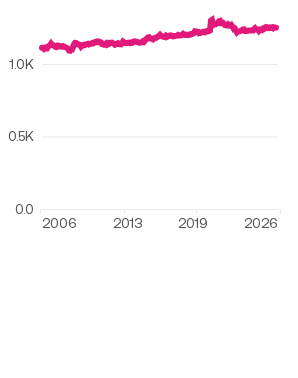

Year-over-year percent change of CPI-U, all urban areas, not seasonally adjusted

The all-time high for a CPI-base inflation rate was in June 1920 at 23.7%.

Year-over-year percent change of CPI-U, all items, not seasonally adjusted

Annual price changes vary widely by type of spending.

Year-over-year percent change of CPI-U (January 2025 to January 2026), by expenditure class, not seasonally adjusted

The inflation rate in the Riverside, CA area was 0.8 percentage points higher than the US city average in January 2026.

Year-over-year percent change of CPI-U (January 2026 to January 2025), not seasonally adjusted

Keep exploring

Methodology

USAFacts standardizes data, in areas such as time and demographics, to make it easier to understand and compare.

The analysis was generated with the help of AI and reviewed by USAFacts for accuracy.

Page sources

USAFacts endeavors to share the most up-to-date information available. We sourced the data on this page directly from government agencies; however, the intervals at which agencies publish updated data vary.