Economy

These states received most of the $350 billion in CARES Act small business loans

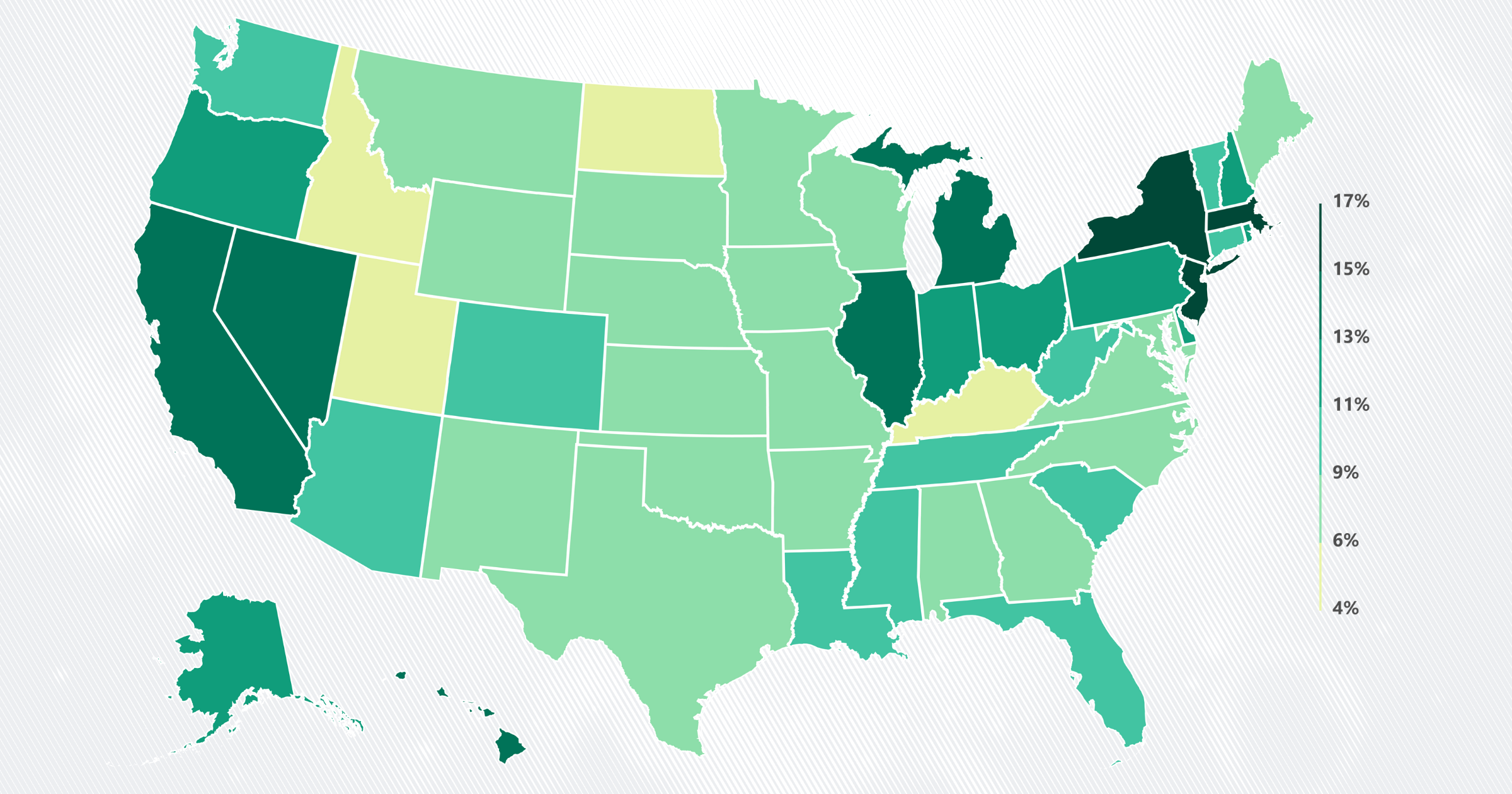

Housing prices jumped during the COVID-19 pandemic as remote work caused many Americans to reconsider their living situations. Rent prices also rose, with inflation-adjusted median rent growing from $1,163 in 2019 to $1,191 in 2021, according to the US Census Bureau.

However, the Department of Housing and Urban Development (HUD) fair market rent data provides a more up-to-date and local look at rent across the US. Calculated fair market rents correspond to the 40th percentile of rent that new tenants in a given area are paying.[1] For example, if a county’s fair market rent for a one-bedroom apartment is $1,000, then 40% of one-bedroom apartments in that county cost less than $1,000 and 60% of rents cost more. Data is updated one to two times every year.

2023 fair market rent data shows that compared to 2020, the last fair market rent data release before COVID-19, one-bedroom unit rents increased in 58% of counties in the US after adjusting for inflation.[2] Rents rose in every county in Arizona, New Hampshire, and Rhode Island while rising in just two of Alaska’s 30 counties. Wyoming and Louisiana also had just a few counties with rent increases.[3]

Counties with the greatest rent swings were small—Brown County in Illinois had a decrease of 34%, while Divide County in North Dakota had the greatest increase in rent at 57%.

However, larger metropolitan areas also had big changes in rent through the pandemic. Counties in the Asheville metro area in North Carolina saw rent increases of 36%, and the Phoenix metro area saw rent increases of 32%. Meanwhile, counties in the San Francisco metro area—Marin, San Francisco, and San Mateo County—dropped 15% over the time period, one of the steepest declines in the country.

Arizona was one of the only states that saw fair market rent increases in every county, but this increase ranged from 1% in Graham County to 32% in Maricopa and Pinal County.

On a local level, changes can be even more drastic. Zip-code-level data in the San Francisco metro area, for instance, reveals neighborhoods that both saw 37% decreases in average fair market rent and 26% increases from 2020 to 2023.

Neighborhoods near Pacifica and South San Francisco had smaller rent decreases than downtown San Francisco and most of Marin County. Although all the counties in the region saw decreases in fair market rent, the changes are extremely local and can be different just a few streets away.

Zoom in on the US map above to see where rents are rising around you.

Read more about standard of living in the US, how COVID-19 changed America and how home prices changed during the pandemic, and get the facts every week by signing up for our newsletter.

These figures are determined by the Census Bureau’s five-year-estimates of housing costs of recent movers from the American Community Survey, supplemented with private data (from RealPage, Moody’s Analytics, CoStar Group, CoreLogic, ApartmentList, and Zillow). This data is normalized by expected inflation projections created by the Bureau of Labor Statistics.

HUD determines fair market rents on a fiscal year basis. As a result, the 2020 data covers the period from October 2019 to April 2020, and the 2023 data was released in October 2022.

Alaska and Louisiana have county-equivalents instead of counties. Alaska has a combination of boroughs and unorganized boroughs, which the Census Bureau divides into county equivalents, and Louisiana has parishes instead of counties.

Economy

Economy

Economy

Economy

Newsletter

Keep up with the latest data and most popular content.